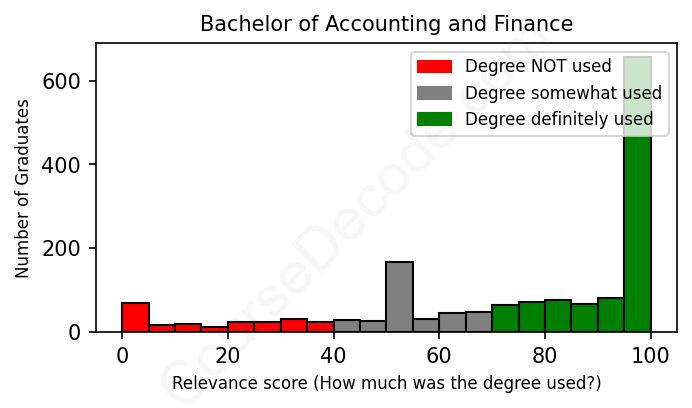

First, some facts. Of the Accounting and Finance graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 1584 LinkedIn profiles (see below).

The verdict? Above average. Overall, with an average relevance score of 73%, Accounting and Finance graduates have a higher likelihood (+6%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 29% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Accounting and Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 50% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2018 from University of Kentucky with a Bachelors Degree in Accounting and Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONContract Specialist Wright Patterson Air Force Aug 2018 - Present ABOUTNo information provided. |

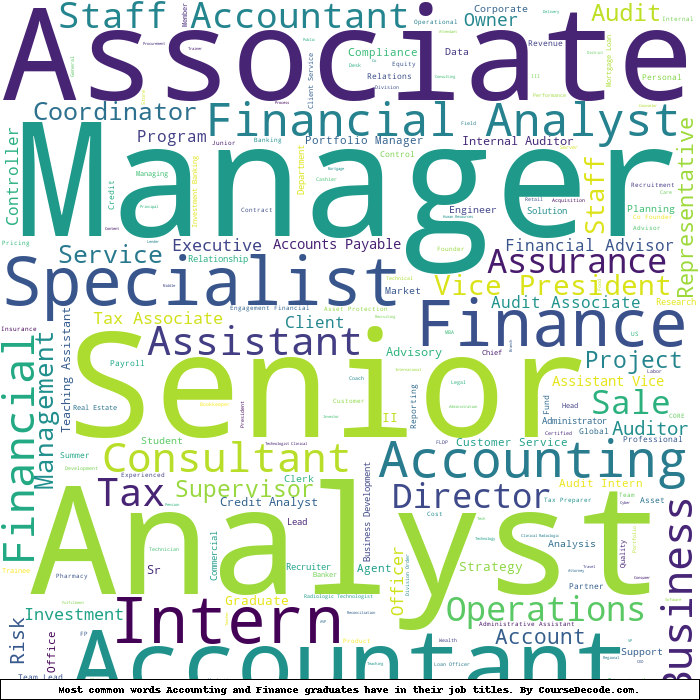

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

Analyzing the professional trajectories of individuals who have graduated with degrees in Accounting and Finance reveals a diverse array of career options, but certain trends emerge in the realm of relevance to their fields of study. Many graduates find themselves in roles directly tied to financial analysis, reporting, and accounting, which clearly align with their educational experiences. Common job titles include Financial Analyst, Staff Accountant, and Tax Associate, all of which utilize core principles of accounting and finance. These positions often require a strong foundation in financial reporting, tax regulations, and compliance standards—areas that are central to the curriculum of an Accounting and Finance degree.

However, among the multitude of roles explored, a significant number of graduates also veer off the traditional accounting path into positions that do not leverage their academic training as effectively. For instance, roles such as Operations Manager, Sales Associate, and even administrative positions—while they may benefit from some basic financial understanding—do not engage the more specialized skills and principles that are central to the degree. This trend indicates that although many graduates secure jobs that are suitably relevant, a notable portion ends up in positions often described as "indirectly related" or only tangentially connected to core accounting and finance tasks. Consequently, while the degree offers a robust foundation for numerous finance-related occupations, graduates sometimes navigate into roles that emphasize broader business skills or operational management over in-depth financial expertise.

In summary, the job market for Accounting and Finance graduates is varied, with a clear prevalence of relevant roles within the fields of finance and accounting. However, it’s essential to recognize the existence of positions that diverge from traditional career paths. Graduates frequently utilize their education in various ways, leading to a mixture of direct and tangential connections to their degree. This exploration underscores not just the dynamic nature of career pathways available to those in the field but also highlights the broader applicability of the skills learned through their academic pursuits.

Here is a visual representation of the most common words in job titles for Accounting and Finance graduates:

When we look at the career trajectories of individuals who have graduated with degrees in Accounting and Finance, a pretty compelling picture starts to emerge. Right after graduation, many of these students tend to secure roles in financial services, auditing, or accounting. For instance, we see positions like "Tax Associate," "Audit Associate," and "Financial Analyst" taking the spotlight, especially in their first few years post-commencement. This trend demonstrates a clear alignment with their academic backgrounds, as these roles require a solid understanding of financial principles and practices that are taught during their degree programs.

As they progress in their careers, say five to ten years later, the narrative becomes even more intriguing. Graduates often move up the corporate ladder, transitioning from entry-level positions like accountants or analysts to senior roles such as "Senior Financial Analyst," "Finance Manager," or even "Director of Finance." We also see a significant number venturing into specialized areas like investment banking or corporate finance, which suggests that the foundational skills gained in their degrees have not only given them solid entry-level positions but also a pathway to advanced and sometimes lucrative careers. This is particularly evident with those who have landed roles at prestigious companies like Goldman Sachs, PwC, and Deloitte.

However, while there are many success stories, it's important to point out that some graduates may find themselves in roles that are less aligned with their degrees. For example, positions in sectors like hospitality or education seem to pop up, reflecting perhaps a necessity for job security or other contributing factors. Not everyone might find a direct line to their field of study, and some may pivot to careers that aren't obviously tied to accounting or finance. But overall, the general trend reflects a strong connection between the academic preparation in accounting and finance and fulfilling, relevant careers in related industries.

Honestly, a Bachelor's degree in Accounting and Finance can be a bit challenging, but it really depends on your strengths and interests. If you enjoy numbers, problem-solving, and analyzing data, you might find it more manageable. However, there's a fair amount of theory, calculations, and really specific principles to learn, which can get tricky at times, especially during exams or when diving into subjects like tax law or financial reporting. It's definitely not the easiest degree out there, but it’s also not the hardest—if you stay organized and put in the effort, you'll get through it just fine!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Accounting and Finance.

Based on the information, it looks like these graduates are doing quite well in their careers. Many of them have moved up the ranks quickly, taking on positions like Senior Financial Analyst, or even Director titles in relatively short time frames. Gradients from reputable institutions like Kelley School of Business and NYU often have the advantage in landing competitive roles, especially in finance and accounting sectors, which generally offer decent salaries. Overall, it's fair to say that a good number of these graduates are likely making decent money, especially those in higher-level positions.

However, not everyone has a similar trajectory. Some graduates, particularly those starting out or who took internships or lower-level positions, might not be pulling in high salaries just yet. But with the way finance and accounting careers tend to progress, many of them could see significant salary increases as they gain experience. If they keep building their skills and connections, they could very well find themselves in lucrative roles down the line.

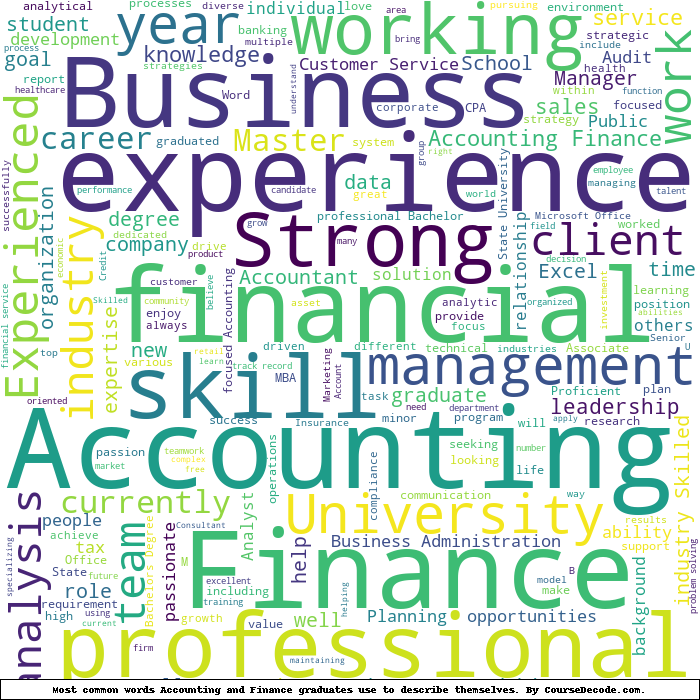

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Accounting and Finance. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Accounting and Finance (ordered by the average relevance score of their Accounting and Finance graduates, best to worst) where we have analyzed at least 10 of their graduates:

| College | Score | Count |

|---|---|---|

Indiana University - Kelley School of Business Indiana University - Kelley School of Business

|

95 | 14 |

Grand Valley State University Grand Valley State University

|

85 | 14 |

Indiana University Bloomington Indiana University Bloomington

|

82 | 14 |

Southern New Hampshire University Southern New Hampshire University

|

71 | 18 |

University of Phoenix University of Phoenix

|

59 | 20 |