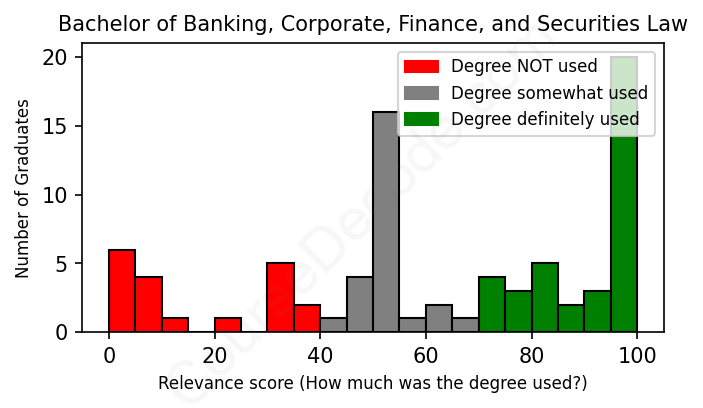

First, some facts. Of the Banking, Corporate, Finance, and Securities Law graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 81 LinkedIn profiles (see below).

The verdict? Below average. Overall, with an average relevance score of 61%, Banking, Corporate, Finance, and Securities Law graduates have a lower likelihood (-6%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 24% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Banking, Corporate, Finance, and Securities Law graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 100% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2017 from Pokhara Vishwavidalaya with a Bachelor of Business Administration - BBA in Banking, Corporate, Finance, and Securities Law. Also pursued further education since (see below). JOB HISTORY SINCE GRADUATIONInvestment Analyst Swyet Swarna Investment Private Limited Feb 2018 - Oct 2019 Research Associate - Financial Services  Evalueserve May 2022 - Apr 2024 Senior Research Analyst  Evalueserve Jan 2024 - Present FURTHER DEGREES DONE SINCE GRADUATINGMaster of Science - MSUniversity of Tampa 2020 - 2021 ABOUTThe desire to learn and comprehend something new has always been my key source of motivation. Despite my Chartered Accountancy background, which focuses on post transaction details, I had always wanted to be a part of the financial services industry. I along with my team had incorporated an investment firm before the completion of our undergrad studies. I was involved in rigorous fundamental as well as technical analysis of the native share market. The involvement led me to various trading houses and Investment banks which gave me firsthand experience in real-time trading of financial instruments. This has broadened my perspective regarding the applications of finance in the real world. I dream of helping individuals create a tertiary source of income, as well as corporations, manage their assets and finances. Be it through active portfolio management or financial advisory, I aim to lead my clients towards financial independency. With my financial expertise, research, and data analytics skills, along with the recently acquired programming languages toolkit, I plan to contribute towards the betterment of the financial market and facilitate data-backed decision-making.Changes are as frequent as ever in the financial industry. Be it the rapid development of technology or change in macroeconomic trends, the impact of these can easily be seen in the financial industry. In the United States, the major challenges in todays financial market are abrupt changes in technology, data analytics, and its impact on productivity and employment, as well as the introduction of blockchain technology in the financial market. I believe, with my financial expertise and in-depth analysis, I can contribute towards a better future for the US capital market. |

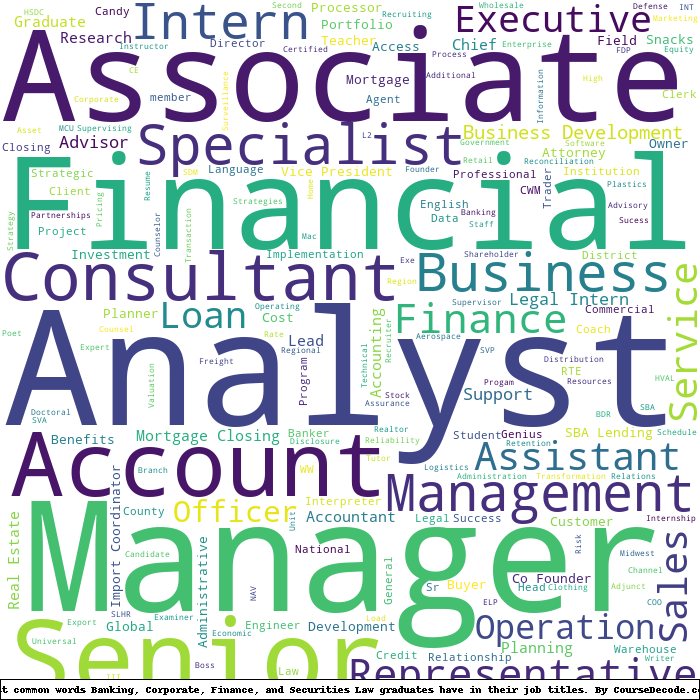

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

After analyzing a slew of LinkedIn profiles belonging to graduates with degrees in Banking, Corporate, Finance, and Securities Law, it's clear that a variety of job roles have emerged. Some of these roles are highly relevant to their degrees, while others only tangentially or not at all relate to the specialized knowledge they acquired. The most common types of jobs seem to revolve around financial analysis, legal counsel, and roles within financial institutions like banks and investment firms. Positions like Financial Analyst, Legal Intern, and Mortgage Specialist frequently pop up, indicating a strong tie between education and career paths in those fields.

However, when you dive deeper into the details, there's a noticeable trend of graduates taking on roles that lack the core banking and legal competencies outlined in their degrees. Positions like Account Manager, Sales Associate, and various administrative roles often do not utilize the specific legal and financial knowledge learned in their studies. Many graduates appear to have found success in roles that require a general understanding of business, finance, or customer relationships, yet these roles may not harness the more complex skills learned during their education. For instance, roles focused on sales, project management, and teaching can seem only loosely connected to Banking, Corporate, Finance, and Securities Law. Thus, while it's encouraging to see that many graduates are finding positions in the finance or legal sectors, a significant portion of their jobs does not reflect a direct engagement with their specialized studies. The paths they follow can often diverge from what one might expect with their firm educational foundations, suggesting that the job market may lead individuals into more generalist roles that don’t fully leverage their degree dimensions.

Here is a visual representation of the most common words in job titles for Banking, Corporate, Finance, and Securities Law graduates:

When you look at the career trajectories of graduates who studied Banking, Corporate, Finance, and Securities Law, there's a pretty mixed bag—some people land solid jobs in their fields right after college, while others seem to struggle to find their footing. Let's break down what you usually see when it comes to their first jobs after graduating and how their careers evolve over the next few years.

For most graduates, especially those from more established schools, the first jobs tend to be in related fields like financial analysis, internships at law firms, or entry-level positions in banking. For instance, many graduates start off as interns or analysts, like the Assurance Intern role or Project Financial Analyst positions. A good number of them are landing jobs at reputable firms right off the bat, suggesting that these degrees do, in fact, lead to relevant opportunities relatively quickly. However, there are also some folks who appear to take detours or work in unrelated roles, which can dilute the effectiveness of their chosen degree in the long run.

Fast forward five or ten years, and you start to see a pattern of upward mobility for many who remained in finance or law-related fields. Graduates from top universities find themselves in senior roles, like portfolio managers or financial analysts at big companies like Morgan Stanley or JPMorgan Chase. Others branch out into entrepreneurship or high-level consultancy. But, then there are those who drift away entirely, ending up in roles that have little connection to their original studies, like sales or even teaching. So, while many graduates do find meaningful and prosperous careers in their chosen sectors, a good number also end up in jobs that don't really utilize the skills they trained for. It's a bit of a rollercoaster—some ride high, while others seem to navigate through the bumps of the job market without quite hitting their targets.

Honestly, a Bachelor's degree in Banking, Corporate, Finance, and Securities Law can be pretty challenging, especially if you're not already into the whole finance and law vibe. There’s a lot of complex material to wrap your head around, like understanding regulations, financial systems, and legal concepts, so it’s definitely not a walk in the park. That said, if you enjoy problem-solving and are good at math and critical thinking, it might not feel as daunting. Overall, I'd say it falls on the harder side of the spectrum compared to other degrees, but with the right mindset and dedication, it’s totally doable!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Banking, Corporate, Finance, and Securities Law.

Looking at these LinkedIn profiles, it seems like the potential earnings for some of these graduates are pretty decent, but it varies a lot across the board. For instance, those who graduated from well-known universities like the University of Texas at Austin and Michigan State University have secured roles with reputable companies like JPMorgan and Morgan Stanley, which usually suggests they are on a pretty solid financial path. On the flip side, some of the earlier career moves, like interns and entry-level positions, don’t necessarily translate to high salaries right away. It might take some time to climb the ladder and really start pulling in the big bucks.

Moreover, graduates who are already in leadership positions, like the "Senior Associate" or "Vice President" titles, are likely making good money, with salaries at major firms often topping six figures as they gain experience. However, those who have only held internships or have just started their careers, like the recent graduates, may still be at the lower end of the pay scale as they just begin establishing themselves in the industry. Overall, while many seem poised for success, some may take longer to see their salaries reflect their law or finance degrees.

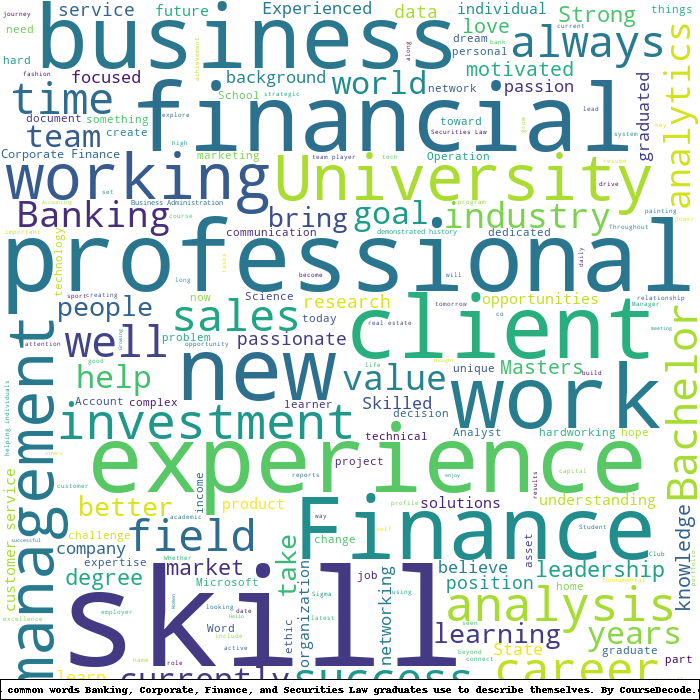

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Banking, Corporate, Finance, and Securities Law. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Banking, Corporate, Finance, and Securities Law (ordered by the average relevance score of their Banking, Corporate, Finance, and Securities Law graduates, best to worst) where we have analyzed at least 10 of their graduates: