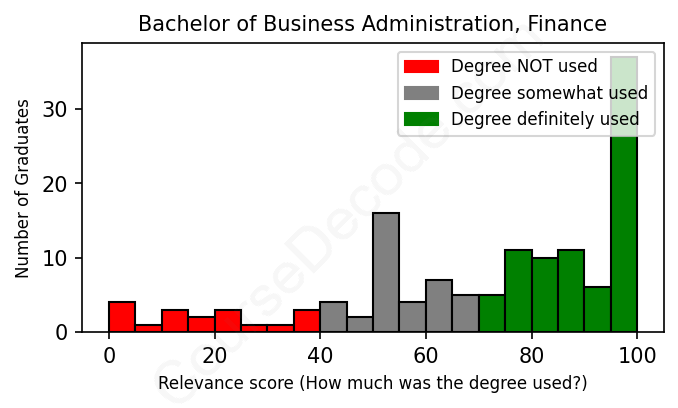

First, some facts. Of the Business Administration, Finance graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 136 LinkedIn profiles (see below).

The verdict? Slightly above average. Overall, with an average relevance score of 72%, Business Administration, Finance graduates have a slightly higher likelihood (+5%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 16% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Business Administration, Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 64% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2013 from University of Missouri-Columbia with a Bachelor of Science (B.S.) in Business Administration (Finance). No other secondary education since. JOB HISTORY SINCE GRADUATIONCommercial Loan Processor Central Bancompany May 2013 - Jul 2013 Velocity Analyst  Cerner Corporation Oct 2013 - Jan 2014 Business Analyst  Cerner Corporation Oct 2013 - Sep 2015 Engagement Controller  Cerner Corporation Sep 2015 - Sep 2017 Senior Engagement Controller  Cerner Corporation Sep 2017 - Dec 2018 Sales Partner  Cerner Corporation Dec 2018 - Mar 2021 Senior Sales Partner  Cerner Corporation Mar 2021 - Mar 2021 Manager | Sales Operations  Cerner Corporation Mar 2021 - Sep 2021 Senior Manager | Business Operations  Cerner Corporation Sep 2021 - Jan 2023 Director of Business Operations  Oracle Jan 2023 - Present ABOUTI drive successful outcomes for organization stakeholders through exceptional business operations management and communication. I strive to bring efficient and productive solutions while maintaining a positive attitude. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When analyzing the different career paths of individuals with degrees in Business Administration and Finance, we find a mixed bag of job titles that reflect varying degrees of relevance to their studies. Many graduates have gravitated toward roles in finance-related fields, but there are also numerous positions that stray into other territories, indicating a broader application of their degree.

Among the most common roles for these graduates, investment banking, financial analysis, and positions within the banking sector stand out. Many individuals took on roles like Investment Analyst, Financial Advisor, or positions within commercial banking that directly tie into financial principles and practices taught in their degree programs. For example, graduates working as Financial Analysts at institutions like M&T Bank or Wells Fargo are applying skills honed during their academic studies, which involves analyzing financial data and making recommendations. Even internship roles in investment management or wealth management have provided graduates with critical hands-on experience in financial settings.

On the other hand, there are several examples of graduates landing jobs that seem only tangentially related to finance. Positions like Customer Service Representative, Teller, or Project Manager in industries unrelated to finance reflect a use of soft skills and business management principles, but not necessarily the core financial competencies developed during their studies. Similarly, graduates working as project managers or in sales roles, such as those mentioned with various tech firms or in hospitality management, often engage in tasks that don't directly apply their finance education, showcasing a disconnect between their academic training and daily job functions.

In summary, while it's clear that many graduates of Business Administration and Finance degrees have taken roles that leverage their educational background effectively, there remains a notable portion who have diverged into less relevant fields. This blend shows how versatile a degree in this field can be but also highlights potential challenges for graduates trying to find a niche that fully utilizes their specialized skills in finance.

Here is a visual representation of the most common words in job titles for Business Administration, Finance graduates:

Looking at the career trajectories of graduates who have studied Business Administration and Finance, it’s pretty clear that there's a significant variety in their paths post-graduation. Many of these individuals have started strong, landing jobs that initially seem aligned with their degrees, such as roles in investment banking, corporate finance, and management positions. For example, graduates from prestigious schools like Pepperdine University and Boston University began with high-profile roles at Goldman Sachs and Wells Fargo Securities, which are impressive starts that can lead to substantial career advancement within finance and consulting sectors. It shows that, for some, the degree can indeed open doors to significant opportunities right out of college.

However, not everyone has taken the same route. A few graduates have started in less glamorous positions, like tellers at banks or customer service roles, and it raises questions about how well their jobs relate to their degrees. For instance, the University of North Carolina at Wilmington graduate who has remained as a bank teller since 2016 isn’t exactly leveraging a business degree to its fullest potential. Over time, we see a mix of success stories where individuals climb the corporate ladder—like the person from Georgia Tech who transitioned from a wealth management intern to senior consultant roles—but also those who have stagnated in positions that may not be inspiring or relevant to their education.

Five to ten years down the line, many of these graduates tend to find themselves in positions of increased responsibility, particularly in finance, project management, or consulting. For example, graduates from Montclair State University and Georgia Tech have made notable advancement into senior roles or specialized positions, suggesting that there's room for growth if they’re willing to stick to their fields. On the flip side, there are stories of graduates from schools like California State University-Fullerton who've progressed into customer service roles that seem less relevant to a business degree, hinting at the reality that success isn’t guaranteed and often depends on market conditions, personal ambition, and sometimes luck.

In conclusion, while many Business Administration and Finance graduates seem to be progressing well into meaningful careers, others appear to be stuck in positions that may not utilize their degree effectively. It's a mixed bag, really. Those who network well, seek continuous learning opportunities, and remain persistent seem to thrive, while others may find themselves in jobs that don’t correlate to their studies at all. If there's any takeaway for high school students looking to pursue a similar path, it’s that a degree is just the beginning; staying engaged, building connections, and constantly seeking growth opportunities are equally important in shaping a successful career.

Honestly, a Bachelor’s degree in Business Administration with a focus on Finance can be a bit of a mixed bag when it comes to difficulty. Some parts can be pretty straightforward, like learning basic business concepts and frameworks, but finance can get tricky, especially when you dive into topics like financial modeling and analysis. You’ll definitely have to tackle some math, especially if you’re not super confident in those skills, and exams can be challenging. Overall, it’s not the hardest degree out there, but it does require a good amount of dedication and effort, so being organized and managing your time well will really help you out!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Business Administration, Finance.

Looking at these LinkedIn profiles, it seems like some folks have really hit the jackpot while others are still on their grind. For example, the graduate from Pepperdine who worked in investment banking at Goldman Sachs and then co-founded a business has likely made some decent cash, especially since investment banking tends to offer hefty salaries and bonuses. On the flip side, the University of North Carolina Wilmington grad who's been a bank teller since 2016 is probably not seeing the same paycheck, since those jobs usually come with lower salaries and minimal career jumping.

Overall, we see a mix of success levels in this group. Those with jobs in investment banking, corporate management, and consulting seem to be making solid money, while others in roles like bank tellers or customer service jobs are likely earning more modest salaries. The key takeaway here is that the degree might open doors, but the specific job roles really dictate how much money you can expect to make.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Business Administration, Finance. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Business Administration, Finance (ordered by the average relevance score of their Business Administration, Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: