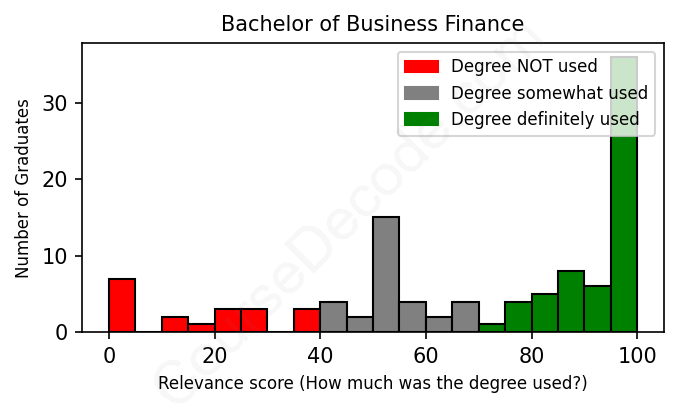

First, some facts. Of the Business Finance graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 110 LinkedIn profiles (see below).

The verdict? Slightly above average. Overall, with an average relevance score of 69%, Business Finance graduates have a slightly higher likelihood (+2%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 18% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Business Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 50% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2023 from Florida Gulf Coast University with a Bachelor of Business Administration - BBA in Business Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONInsurance Representative GEICO Mar 2023 - Present ABOUTHi, my name is [NAME REMOVED] Williams. I am currently studying business finance at Florida Southern College. I am interested in analyzing financial data and applying insights for decision-making. Upon getting my degree, my goal is to take all the knowledge I have acquired from my education and experiences to provide value to my career. |

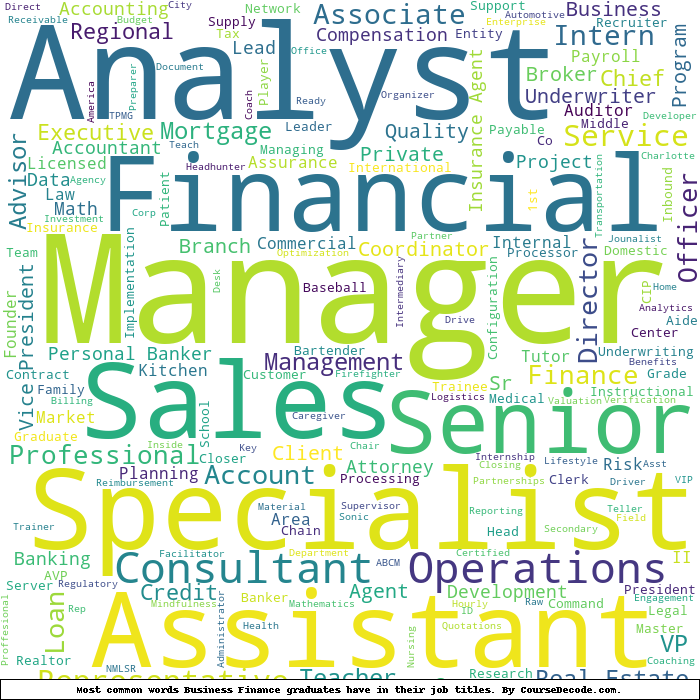

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

After analyzing the various job trajectories of individuals who hold degrees in Business Finance, it’s clear that there are diverse career paths they tend to follow. Many graduates have landed jobs in banking, finance, and accounting, while others found roles in sales, education, and healthcare. The most common types of jobs include positions like Financial Analyst, Personal Banker, Loan Officer, and various roles within the insurance and accounting sectors. These positions usually utilize the knowledge and skills acquired during their studies, such as financial analysis, risk assessment, and strategic planning. However, there are also instances of graduates taking on roles that seem only marginally related or even unrelated to Business Finance.

Overall, a significant number of the jobs held by these graduates exhibit strong relevance to their Business Finance degrees, particularly those centered around financial management, analysis, banking, and accounting. For example, roles like Financial Analyst or Accounting Specialist directly tap into the core competencies taught in Business Finance programs. However, many have ventured into fields where their degree does not appear to have provided them with direct benefits, such as roles in customer service, sales, or education. Positions in healthcare, like being a caregiver or a nurse's aide, had little to no connection to their finance training. While some of these jobs might incorporate general business skills, such as operational management or client relations, they often lack the deeper financial insight that a degree in Business Finance offers.

In conclusion, while a good number of graduates have managed to secure jobs that closely align with their educational background, many have taken on roles that do not fully utilize their Business Finance knowledge. This disparity indicates a broader trend where graduates might be applying their degrees in less conventional ways or entering job markets that prioritize skills other than finance. Ultimately, the effectiveness of a Business Finance degree in shaping a graduate's career appears to be context-dependent, varying significantly based on individual choices and market opportunities.

Here is a visual representation of the most common words in job titles for Business Finance graduates:

When looking at the career trajectories of Business Finance graduates from various institutions, it’s clear that there's a fair mix of outcomes, with some finding solid careers relevant to their degrees, while others have diverged significantly from their initial paths. Many graduates start in entry-level positions that are somewhat aligned with their education in finance, but as we look five to ten years down the line, the career paths can vary widely based on individual choices, opportunities, and sometimes unexpected shifts in interests.

For many graduates, the first job after completing their degree often includes positions like tellers at banks or entry-level financial analyst roles. For instance, a number of graduates from the University of Phoenix began careers in home health or insurance, which, while decent and stable, aren't strongly aligned with traditional business finance roles. As time passes, we see some individuals pivoting away from finance-focused roles altogether. Someone from the University of Nebraska at Omaha initially worked in sales and transitioned into journalist and director positions, while others shifted into positions in areas like healthcare or education that might not directly utilize their degrees. A few graduates, however, have turned their early positions into management-level jobs in finance or analytics, indicating that some definitely leveraged their degrees effectively.

Five to ten years after graduation, many seem to find their footing in finance-related roles such as financial analysts or managers in companies where they can make more of an impact. For instance, graduates from universities like Texas Tech University and Liberty University have taken their degrees into impactful roles in analytics, investments, and even banking. On the other hand, numerous individuals have also ventured into other fields entirely, which might suggest they found finance to be less fulfilling than expected or faced challenges breaking into the field. In conclusion, while some graduates have managed to establish solid careers in finance, there is a significant number that appears to have strayed into other industries. This mix is pretty common, with some graduates excelling in finance while others follow completely different passions or interests over time.

A Bachelor’s degree in Business Finance can be a bit of a mixed bag in terms of difficulty, honestly. It’s not the hardest degree out there, but it does require a decent amount of math, critical thinking, and some strong analytical skills, so if you're not a fan of numbers or working with data, it might feel a bit challenging at times. You'll also have to juggle different subjects like accounting, economics, and finance principles, which can get intense, especially during finals. That said, if you enjoy the subject matter and stay on top of your coursework, it’s definitely manageable and can even be fun!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Business Finance.

When looking at the career paths of these Business Finance graduates, it's a mixed bag. Some of them have definitely landed lucrative roles, especially those who have worked their way up in finance or banking, like the one from North Dakota State University who is now a VP at Bell Bank, or the one from Southern New Hampshire University who's a Manager at Liberty Mutual Insurance. If they’ve been in finance or tech for a longer period, they’re likely making solid money, possibly hitting six figures. On the flip side, some have been in lower-paying jobs for quite a while, like healthcare aides or teaching, which typically pay less. They might not be raking in the dough compared to their peers in finance or management positions, but it's possible they find fulfillment in their work.

In general, those who graduated more recently or are still in internships might not be making a ton at the moment. But that doesn't mean they won't get there eventually. The ones who are showing upward mobility in their careers, particularly in finance or management, have a better chance at decent salaries in the next few years. Overall, it all depends on their specific roles and how much experience they gain moving forward. But hey, even if some paths seem less lucrative now, the future could hold big opportunities if they keep pushing onward!

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Business Finance. This may or may not be useful: