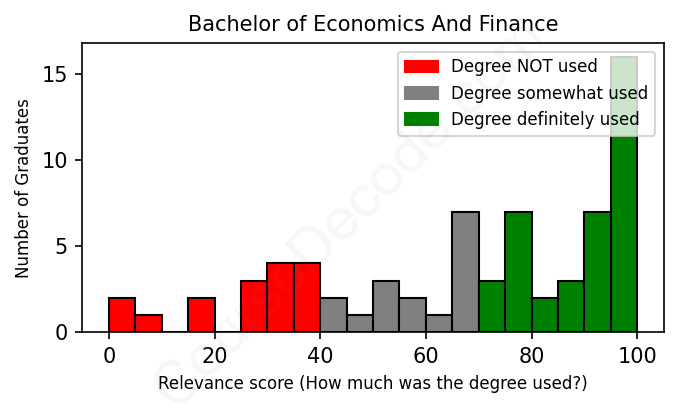

First, some facts. Of the Economics And Finance graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 70 LinkedIn profiles (see below).

The verdict? On par with the average. Overall, with an average relevance score of 67%, Economics And Finance graduates have about the same likelihood of finding work in this field as the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, 47% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests you may need more than just a Bachelors degree to be competitive as a Economics And Finance graduate.

See the details:

|

Relevance score: 33% We think this person has NOT gone into a career related to their degree. We think this person has NOT gone into a career related to their degree.

DEGREE INFOGraduated in 2017 from Auburn University at Montgomery with a Bachelors in Economics And Finance. Also pursued further education since (see below). JOB HISTORY SINCE GRADUATIONStaff Budget Analyst State of Alabama Feb 2020 - Aug 2021 Engineer  Byers Engineering Company Aug 2021 - Present FURTHER DEGREES DONE SINCE GRADUATINGMaster of Arts - MAUniversity of Alabama, Manderson Graduate School of Business 2017 - 2018 ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When analyzing the career paths of individuals who have earned degrees in Economics and Finance, a distinctive pattern emerges regarding the types of jobs they commonly secure and how relevant these roles are to their academic backgrounds. Many graduates of Economics and Finance programs find themselves working in financial analysis, investment banking, and related roles that leverage their understanding of economic principles and financial systems. These positions often involve direct application of analytical skills, economic theory, and financial strategies, making them quite relevant to their education.

In reviewing the various profiles, the jobs most frequently occupied by these graduates include positions like Financial Analysts, Investment Analysts, Project Managers, and roles in Wealth Management. These jobs typically require strong quantitative skills and an understanding of market dynamics, both of which are essential teachings in Economics and Finance curriculums. For instance, roles in investment banks or financial services companies necessitate a high level of financial acumen, directly corresponding to the core competencies of the degree. Many graduates successfully transition into these environments, utilizing their educational knowledge to excel in key financial tasks.

On the other hand, it was notable that some graduates took their degrees into less traditional fields where the application of Economics and Finance principles is more tenuous. Positions in marketing, operations management in non-financial sectors, or various administrative roles often do not leverage the specialized skills developed during their degree. For instance, jobs like Marketing Director or Project Manager in unrelated fields may involve economic principles only in a superficial capacity, emphasizing operational effectiveness rather than in-depth financial analysis. This presents a mixed picture: while many graduates find themselves in roles that demand their expertise, others end up in positions that may not fully utilize their academic preparation. Therefore, while a significant portion of Economics and Finance graduates effectively enter relevant job markets, there remains a notable subset whose positions diverge substantially from their formal education, suggesting a need for clearer pathways or further guidance in career planning.

Here is a visual representation of the most common words in job titles for Economics And Finance graduates:

When looking at the career trajectories of graduates with degrees in Economics and Finance, there's a pretty clear pattern that emerges. Right after graduating, many of them land their first jobs in finance-related roles, often starting as analysts, associates, or interns. For example, graduates from prestigious schools like University of Texas at Austin or Georgia State University jump right into positions that are closely tied to finance, such as financial analysts or investment operations, which is something to note if finance is your thing. In short, a lot of these grads are beginning their careers in roles that directly correlate with their degrees, which is a significant advantage in a competitive job market.

Fast-forward five or ten years later, and many of these people seem to be climbing the corporate ladder quite nicely. Their career paths often see them transitioning into higher management roles or specialized positions within finance that require significant experience and expertise. Some graduates from well-known schools have even moved into director or VP roles at respectable companies, which highlights how valuable an Economics and Finance degree can be. However, it's also essential to recognize that a few graduates have taken different routes, veering into unrelated fields or starting their businesses. For instance, someone with a finance background might end up running a construction company or working in different industries, which suggests that while there's a strong trend towards finance, some opt for a more unconventional path.

So, what's the takeaway? For many, a degree in Economics and Finance can pave the way to a solid career in finance or related fields, especially if you start in a finance-related position right out of college. But, there's also the reality that not everyone sticks strictly to finance; some graduates carve out unique paths that might not directly relate to their degrees. Overall, if you're considering this field, there's good potential for success, but keep an open mind about where your degree might take you!

A Bachelor’s degree in Economics and Finance can be a bit of a mixed bag when it comes to difficulty, but I’d say it leans toward being on the harder side of average. You’ll dive into a lot of complex topics like micro and macroeconomics, statistics, and financial analysis, which can feel overwhelming, especially if math isn’t your strong suit. That said, if you enjoy problem-solving and have a genuine interest in how the economy works, it can be really engaging. Just be prepared for some heavy reading and lots of number-crunching, but with the right mindset and effort, it’s definitely manageable!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Economics And Finance.

Looking at these graduates, it seems like some of them are making good money while others might be struggling a bit. For example, that graduate from Universit Commerciale 'Luigi Bocconi' has climbed the ranks at GE Power, landing a senior role that likely pays well. Meanwhile, the person from The University of Texas at Austin has been with the Texas Tech University System for a long time; being a Deputy Director suggests a solid salary, too. On the other hand, some recent grads, like the one from Centre College or the one from Nebraska-Lincoln, are still in entry-level or mid-level roles, which probably means their pay isn't as high yet, but they might be in a position to grow their income soon.

Overall, it looks like a mixed bag. Some folks are clearly on pathways that lead to decent salaries, especially in finance or corporate roles. However, others are still building their careers and might not be seeing a hefty paycheck just yet. As a high school student, it’s good to remember that starting salary doesn’t define how much you can earn later on; experience and skills can really ramp up your earnings down the road!

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Economics And Finance. This may or may not be useful: