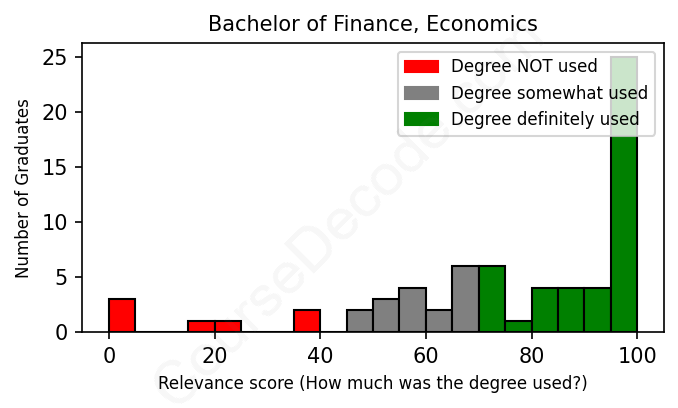

First, some facts. Of the Finance, Economics graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 68 LinkedIn profiles (see below).

The verdict? Above average. Overall, with an average relevance score of 77%, Finance, Economics graduates have a higher likelihood (+10%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, 36% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests you may need more than just a Bachelors degree to be competitive as a Finance, Economics graduate.

See the details:

|

Relevance score: 68% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2018 from Ohio Wesleyan University with a Bachelor of Arts (B.A.) in Finance Economics. No other secondary education since. JOB HISTORY SINCE GRADUATIONAssociate Financial Analyst Greif, Inc. Jun 2018 - Oct 2019 Financial Analyst  Greif, Inc. Oct 2019 - Sep 2020 COO, Co-Founder  Spurge Technologies Sep 2020 - Present ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

After digging through this extensive list of LinkedIn profiles, it's clear that graduates with degrees in Finance and Economics tend to lean towards certain job types more than others. For example, many individuals have found roles in financial analysis, banking, and consulting. Jobs such as Financial Analyst, Investment Banking Analyst, and roles at large financial institutions like Capital One or JPMorgan Chase are quite common. These positions typically demand a solid understanding of financial concepts, economic theories, and analytical skills—exactly what's taught in Finance and Economics programs.

However, while some professionals do land roles that are highly relevant to their educational background, a surprising number have taken positions that barely touch on finance or economics. We see many examples of graduates working in marketing, sales, and even consulting roles that don't require the depth of financial knowledge one might expect given their degree. For instance, positions like SEO Analyst, Brand Manager, or even Customer Service Representative appear regularly, showing that many graduates have diverged from their core studies. Meanwhile, roles specific to finance, like those at investment firms or banks, absolutely utilize their training daily. Overall, there's a mix; many find solid positions related to their field, while others tread a less relevant path post-graduation.

Here is a visual representation of the most common words in job titles for Finance, Economics graduates:

When looking at the career trajectories of graduates who studied Finance and Economics, a few trends emerge that paint a picture of what many of these individuals went on to do. Generally, it's clear that most of them started with internships or entry-level positions that closely align with their degrees. For example, many landed roles as analysts, which is a common first step in the finance world. Positions like "Operations Analyst," "Financial Analyst," and "Investment Banking Analyst" were frequent first jobs. This emphasis on relevant experience right out of school indicates that these graduates were indeed making solid choices to jumpstart their careers in finance and economics.

Fast forward a few years and we see a mix of solid progress along traditional finance career paths, alongside some less linear trajectories. Graduates from reputable schools often make significant leaps, moving from analyst roles to managerial or directorial positions within a relatively short period. For instance, several individuals progressed from being analysts at places like JPMorgan Chase or Capital One to more senior leadership roles in just 5-10 years. This upward trajectory suggests that those who remain in their chosen fields, especially in finance-related roles, see considerable upward mobility.

However, not every graduate maintained a focus on finance or economics. Some shifted to roles that are tangentially related or completely unrelated to their original field of study. For example, a few graduates ended up in marketing or consulting roles that don't directly leverage their finance education. While this isn't inherently a negative thing, it's worth noting that not all paths remained strictly within finance. Overall, while many graduates have solid careers in finance and economics, the paths for others show a more varied approach. Some ventured into different industries or switched directions entirely, which indicates that career flexibility is another aspect of post-graduate life.

In conclusion, most graduates with degrees in finance and economics initially gravitate towards relevant roles, such as financial analysts or operations analysts, and many see consistent upward mobility within those fields. However, there is also a notable number who transition out of finance into other areas, reflecting the diverse nature of career trajectories available in today's economy. As a high school student, it's important to realize that while a degree can set you on a strong path, your career can evolve in many ways that may lead you far beyond your original field of study.

A Bachelor’s degree in Finance or Economics can be pretty challenging, but it really depends on your strengths and interests. If you enjoy math and have a knack for analytical thinking, you'll probably find some parts easier than others. However, there’s a fair amount of complex concepts, statistics, and critical thinking involved, especially when you start diving into subjects like microeconomics or financial modeling. Overall, it's definitely a step up from high school, but with dedication and the right mindset, it's totally manageable. Just be ready for some late nights studying those equations and theories!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance, Economics.

It seems like some of these graduates have really climbed the financial ladder while others are still finding their footing. For example, the grad from Hofstra University who went from senior analyst to vice president at Summit Mitsui Banking Corporation is likely making some serious cash now, especially considering the positions held at Capital One. Similarly, the University of Notre Dame grad in investment banking is probably doing well since those positions typically offer high salaries.

On the flip side, there are others who have had a more mixed bag of job experiences. The Copenhagen Business School grad, for instance, has moved through a series of contract and intern roles before getting into data and SEO work, which may not pay as handsomely as in those higher-tier financial analyst roles. Overall, if you’re looking at potential earnings, the ones who secured roles at bigger financial firms or moved quickly into management seem to be in better shape than those still working in juniors or contract positions.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance, Economics. This may or may not be useful: