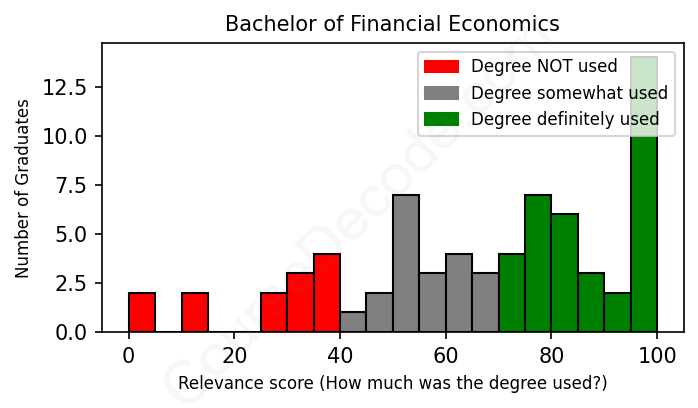

First, some facts. Of the Financial Economics graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 69 LinkedIn profiles (see below).

The verdict? Slightly below average. Overall, with an average relevance score of 66%, Financial Economics graduates have a slightly lower likelihood (-1%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 27% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Financial Economics graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 84% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2023 from Binghamton University with a Bachelor of Science - BS in Financial Economics. No other secondary education since. JOB HISTORY SINCE GRADUATIONSummer Internship Catalyst Capital Advisors May 2023 - Sep 2023 Commercial Real Estate Intern  Project Destined Sep 2023 - Nov 2023 Commerical Real Estate Brokerage Intern  Pyramid Brokerage Company Jan 2024 - Present ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When looking at the job trajectories of individuals who graduated with a degree in Financial Economics, we see a wide array of positions across various sectors, reflecting the diverse paths that graduates may follow. Some of the most common roles include financial analysts, data analysts, risk management positions, and roles in financial advisory and consulting firms. These jobs align well with the skills and knowledge students are expected to acquire in their degrees. However, the relevance of these jobs to Financial Economics varies significantly.

Many graduates have found roles such as financial analyst or risk analyst, which directly utilize skills learned in Financial Economics. For example, positions at firms like Morgan Stanley and Capital One require a deep understanding of financial principles, allowing graduates to apply their education effectively. Others transition into roles such as financial advisors or consultants, which also align closely with their studies, focusing on wealth management, client financial planning, or investment strategies. These roles typically demand a solid grasp of market dynamics and economic theories, further demonstrating the value of the degree in practical settings.

Despite these relevant positions, a substantial number of graduates take on roles that do not heavily rely on their Financial Economics education. Common examples include jobs in customer service, sales, and administrative positions, such as being a Customer Service Representative or a Relationship Manager without a deep focus on financial analysis. Additionally, some notably divergent career paths, like working as a legal assistant or project coordinator, show that while graduates possess a strong educational background, they may end up in roles that diverge from their area of study. This suggests that while the degree provides valuable skills, many graduates use them in varied contexts, not strictly tied to financial economics.

In conclusion, while a good portion of Financial Economics graduates find roles that capitalize on their knowledge and skills, many also venture into positions where the connection to their field of study is less direct. Financial firms and consulting positions largely benefit from the specialized education the graduates received. At the same time, the diverse job landscape shows that financial economics can open doors to a multitude of careers, albeit sometimes in ways that don't require daily applications of their academic training.

Here is a visual representation of the most common words in job titles for Financial Economics graduates:

The career trajectories of graduates with a degree in Financial Economics can really vary widely, and analyzing the job histories of these individuals from different colleges shows a mix of both promising and less-than-ideal paths. Generally, many of these graduates kick-start their careers in fairly relevant positions. For instance, we see some starting out in roles like leasing professionals, data analysts, or even financial advisory positions at respected firms like Deloitte and Morgan Stanley. This is a good sign, indicating that many of these recent grads are getting their foot in the door at companies that relate directly to their field of study, which is Financial Economics.

However, the picture starts to get a bit muddier as we look further down the line—like five or ten years into these careers. While some graduates have clearly ascended to high-level roles, such as Vice President positions at major banks or becoming senior analysts and managers at top financial firms, others have drifted into roles that seem only tangentially related to Financial Economics. For example, some are working in sales or customer service positions that, while they might utilize some of the skills gained during their studies, don't directly apply the theoretical knowledge of economics and finance. It’s particularly notable when graduates end up in roles like retail management or administrative positions, which might not have much to do with their Financial Economics education.

Overall, it does look like a good number of these graduates are finding success in careers that leverage their degrees. There’s a solid group moving into finance-focused roles at Universities, hedge funds, consulting firms, and major banks. Still, there's also a significant contingent that, while working, might not be utilizing their degree in the way they expected. This duality highlights a crucial reality: while a degree in Financial Economics can pave the way for many lucrative opportunities, the outcomes can greatly depend on individual choices and economic conditions after graduation.

A Bachelor’s degree in Financial Economics can be pretty challenging, but it’s not impossible if you’re willing to put in the effort. You’ll dive into a mix of economics, finance, and quantitative analysis, which means you’ll be dealing with numbers, graphs, and a fair bit of mathematical concepts. If you enjoy math and critical thinking, you might find it interesting, but if you struggle with those areas, it could definitely feel tough. Overall, I’d say it’s a bit harder than some degrees, mainly because of the analytical skills required, but with the right mindset and study habits, you can totally handle it!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Financial Economics.

Looking at the job histories of these graduates, it seems like some of them are doing quite well financially, especially those who are already in higher positions at reputable companies like Deloitte, Capital One, or JP Morgan. For instance, graduates from Binghamton University and Columbia University appear to have jumped into solid roles with big firms, suggesting a decent salary right out of school. On the other hand, there are also some who have taken longer career paths with lower-paying roles initially, like the ones from Denison University and those who transitioned through multiple internships before landing solid jobs, indicating a slower financial growth. Overall, while some are on a fast track to good earnings, others may need a bit more time to climb that financial ladder.

For the ones who have landed jobs at places like Vanguard or in upper management at firms, it’s likely they’re earning a good salary, especially considering the industries they’re in. However, others, especially those starting with internships or customer service roles right after graduation, might still be working their way up and could be making less than they’d like in the early stages of their careers. So, it really just depends on individual circumstances and how well they leverage their skills and experiences moving forward!

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Financial Economics. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Financial Economics (ordered by the average relevance score of their Financial Economics graduates, best to worst) where we have analyzed at least 10 of their graduates:

| College | Score | Count |

|---|---|---|

University of Maryland Baltimore County University of Maryland Baltimore County

|

68 | 12 |