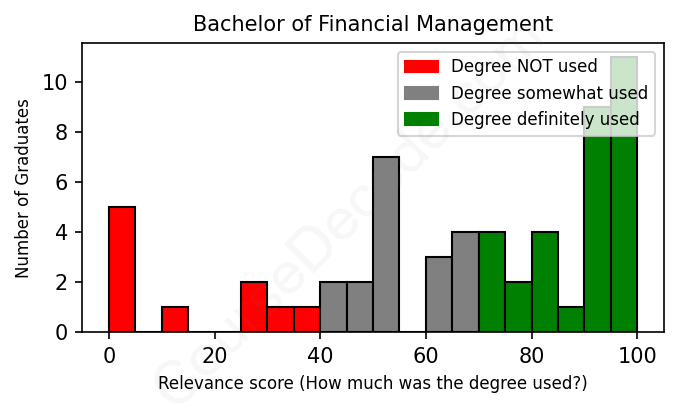

First, some facts. Of the Financial Management graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 59 LinkedIn profiles (see below).

The verdict? Slightly below average. Overall, with an average relevance score of 65%, Financial Management graduates have a slightly lower likelihood (-2%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, 52% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests you may need more than just a Bachelors degree to be competitive as a Financial Management graduate.

See the details:

|

Relevance score: 98% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2011 from Franklin University with a Bachelor in Financial Management. No other secondary education since. JOB HISTORY SINCE GRADUATIONBranch Manager River Valley Investment Services Apr 2011 - Dec 2012 Operations Manager  WoodTrust Investment Services Dec 2012 - Feb 2024 Wealth Administrative Assistant  Nicolet Wealth Management Feb 2024 - Present ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

After diving through a plethora of LinkedIn profiles of graduates in Financial Management, it’s pretty clear that many of them have embarked on quite a range of careers. Some of these jobs are closely aligned with financial management principles, while others take different paths where the connection to their studies isn't as strong. One common trend is that many graduates have found themselves in analyst roles, whether that's a Financial Analyst or an Analyst in a different field. These roles typically require a solid grasp of financial principles and are directly related to the skills they developed during their degree programs. Positions in companies like Wells Fargo, EY, and Apple, where financial expertise is key, are perfect examples of jobs that fully leverage their educational backgrounds.

On the flip side, there are also instances where graduates have taken on roles that are less relevant to financial management. Jobs like Customer Service Representative, Sales Associate, or even roles in completely different industries—such as being a Certified Flight Instructor—highlight a significant detachment from the financial management curriculum. In some cases, while they may engage in financial activities, the core responsibilities of these positions do not necessitate the specialized knowledge that comes from a Financial Management degree. Additionally, some graduates have landed managerial or administrative positions where financial duties might be part of the job but are not the primary focus, like Executive Assistant positions or Project Managers in non-financial sectors.

So, in summary, the landscape of jobs for Financial Management graduates is a mixed bag. While many find themselves in roles where they can apply their financial knowledge directly—such as analysts, accountants, and financial examiners—others take interesting detours that might not utilize their hard-earned skills as much as one would hope. It shows that a degree in Financial Management can lead to various paths, but the relevance of one's job to that degree can vary significantly. It all boils down to the type of work each individual pursues after graduation and how they choose to apply their knowledge in the real world.

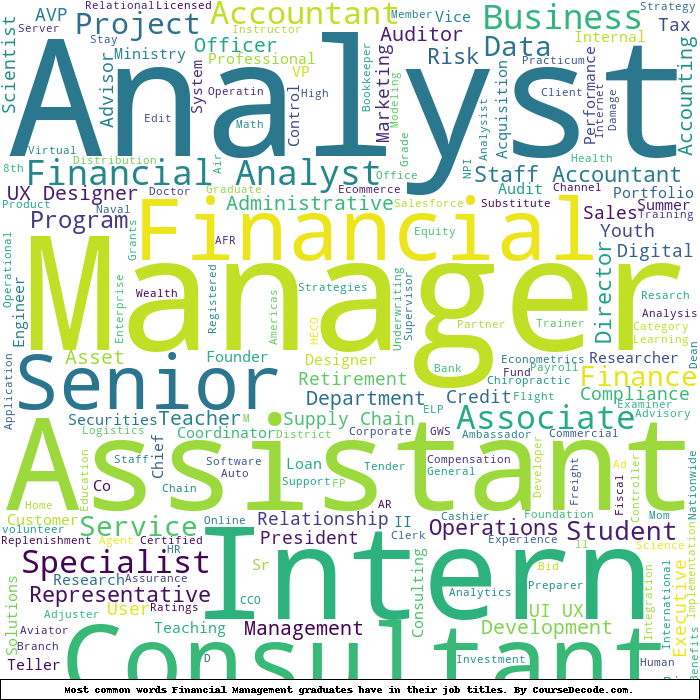

Here is a visual representation of the most common words in job titles for Financial Management graduates:

When analyzing the career trajectories of Financial Management graduates, it's clear that the outcomes vary significantly across different individuals. Often, these graduates tend to kick off their careers with internships or entry-level positions related to finance, analytics, or operations. For instance, several graduates started as interns or junior analysts, laying a solid foundation in their field. This trend is evident in cases like the graduate from Dongbei University who held two internships right after graduation, and others who secured positions in financial roles or examinations shortly thereafter.

Fast forward five to ten years, and many graduates of Financial Management seem to ascend into mid-level or even senior roles within their organizations, particularly if they took on relevant positions early on. For example, a few graduates from institutions like California Polytechnic State University have climbed the ranks to roles such as Portfolio Manager and Associate Asset Manager. However, there are others who have strayed from traditional finance roles, taking up positions in sales, teaching, or even entirely different sectors. This suggests that while some graduates find rewarding paths directly linked to their field of study, others may not secure careers grounded in Financial Management principles.

Overall, it seems that graduates with focused career paths in finance are doing reasonably well, achieving roles that align with their studies. But there are certainly cases where individuals have ventured off-course, finding success in unrelated areas. So, while it's possible for a Financial Management degree to lead to a fruitful career in finance, not everyone ends up where they might have initially hoped. It’s a mixed bag, highlighting the importance of networking, internships, and making career-aligned choices right from the start.

A Bachelor’s degree in Financial Management can be a bit challenging, but it's not the hardest degree out there—kind of like a medium spiciness level on a hot sauce scale. You'll definitely dive into numbers, finance principles, and maybe even some complex stuff like risk management and investment strategies. If you have a knack for math and enjoy problem-solving, it might feel a bit easier for you. There will be times when it gets tough, especially when you're juggling multiple projects or studying for exams, but with some good study habits and a bit of dedication, you can totally handle it!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Financial Management.

Looking at these LinkedIn profiles, it seems that some graduates are on a pretty good path when it comes to their careers and potential earnings, while others might not be making the big bucks just yet. For instance, graduates from major universities like California Polytechnic State University and Clemson seem to have landed solid positions with titles like VP and Portfolio Manager, which usually come with decent salaries. On the other hand, some recent grads or those starting out in their fields, like the Financial Examiner or the Grants Accountant, may be starting off with lower salaries typical of entry-level positions. It really varies based on their job roles and where they are in their careers.

Overall, while some of these individuals are on roles that likely lead to comfortable earnings, others are in more basic positions that don’t typically break the bank. It’s also worth noting that early career roles can sometimes be just a stepping stone to better-paying jobs down the line. So, if you’re considering a career in financial management, remember that your starting salary may not reflect your potential income as you climb the corporate ladder!

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Financial Management. This may or may not be useful: