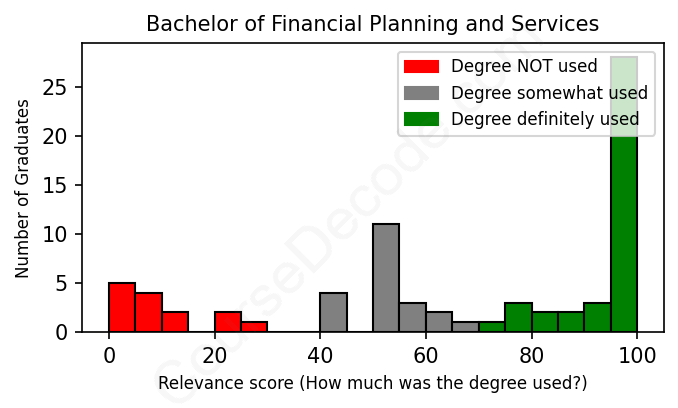

First, some facts. Of the Financial Planning and Services graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 74 LinkedIn profiles (see below).

The verdict? Slightly below average. Overall, with an average relevance score of 66%, Financial Planning and Services graduates have a slightly lower likelihood (-1%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 12% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Financial Planning and Services graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 77% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2016 from Texas A&M University with a Bachelor of Business Administration (B.B.A.) Finance, Certificate in Financial Planning Program in Financial Planning and Services. No other secondary education since. JOB HISTORY SINCE GRADUATIONClient Associate Carter Financial Management Jun 2016 - Aug 2018 Associate  Clintsman Financial Planning Sep 2018 - Jan 2020 Financial Advisor  Clintsman Financial Planning Jan 2020 - Jan 2023 Associate Wealth Advisor  Buckingham Strategic Wealth Sep 2018 - Jan 2024 Wealth Advisor  Buckingham Strategic Wealth Jan 2024 - Present ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When looking at the various careers of individuals who graduated with a degree in Financial Planning and Services, it's pretty clear that many have landed jobs closely related to their field of study. A good number of them took roles as financial advisors, which is a direct line of work for someone with this kind of educational background. Positions like Financial Associate, Financial Planner, and Financial Analyst pop up frequently, showcasing the degree's relevance to practical financial planning duties. These jobs typically involve managing finances, providing investment advice, and helping clients achieve their financial goals, which are all tasks fundamental to financial planning.

However, not every job on the list has directly tapped into the skills and knowledge that come with a degree in Financial Planning and Services. Some graduates have taken up roles that seem pretty far from their studies, like administrative positions or jobs in customer service, where financial expertise isn’t a key requirement. For instance, roles like Signing Agent, Utility Coordinator, or even Construction Superintendent don’t necessarily require the specialized financial planning skills that these graduates were trained in. So, while it's great to see many graduates succeeding in finance-oriented roles that make use of their degree, there's a sizable chunk of the group that appears to have stepped into less relevant positions where their specific training isn’t directly applied. Overall, the common trend for those who pursued careers directly linked to finance shows that the degree is beneficial, but there are plenty of paths chosen that veer off from financial planning itself.

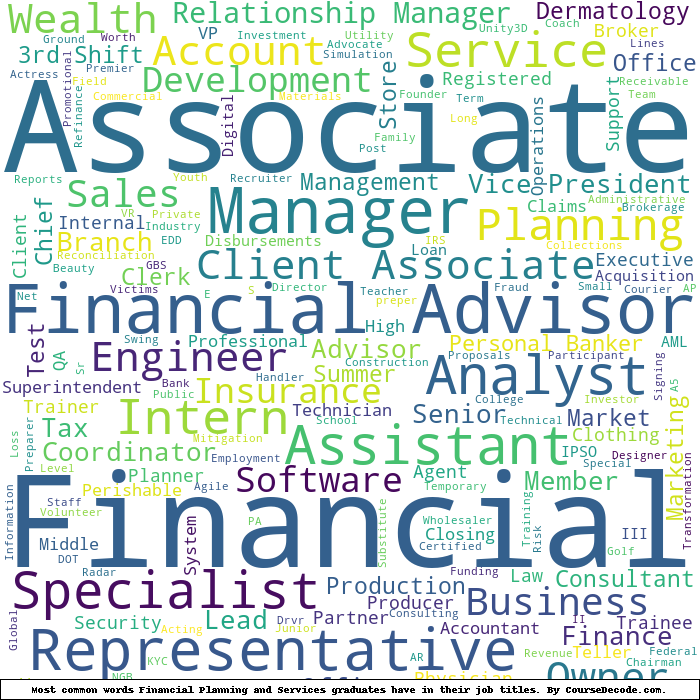

Here is a visual representation of the most common words in job titles for Financial Planning and Services graduates:

Looking at the career trajectories of graduates with degrees in Financial Planning and Services, it seems like there’s a mixed bag of outcomes. Right out of college, many of these graduates are landing roles that are directly related to finance, such as financial advisors, client associates, or even financial analysts. For instance, a University of North Florida grad went from being an intern to a financial advisor fairly quickly. Similarly, those from schools like the University of Wisconsin-Madison appear to be securing relevant positions almost immediately after graduation, like the associate financial advisor role they took on. This suggests that there are indeed opportunities out there for fresh financial planning graduates, especially if they're proactive and leverage internships effectively.

Fast forward five to ten years post-graduation, and we see even more specialization in career paths. Many of the graduates who started in entry-level positions as financial associates or client representatives have moved up to more senior roles, like financial planners or even partners in wealth management firms. For example, the graduate from California State University-Sacramento who began as an advisor has moved on to owning their own financial planning firm, which is pretty impressive. However, there are others who seem to drift away from finance altogether. Some have ended up in more unrelated jobs, like a grad from East Carolina University pivoting into dermatology. This indicates that while there are solid prospects for career advancement in financial planning, some individuals may take unexpected turns, probably due to personal interests or opportunities that arise along the way.

Overall, it looks like many of these graduates tend to find their way into relevant fields related to their degree. The first jobs often set a foundation for a career in finance, and with a few years of experience, there are paths that lead to more esteemed positions. Yet, it's clear that not everyone stays within the boundaries of financial services, which could reflect the diverse interests of graduates or perhaps a lack of passion for the field after dipping their toes into the working world. For students considering a degree in Financial Planning and Services, it’s promising to know that there’s a legitimate pathway into the financial sector, but keeping an open mind about other career opportunities is also wise.

Honestly, a Bachelor's degree in Financial Planning and Services can be a bit of a mixed bag. It's not the easiest degree out there, but it's also not the hardest if you keep up with your studies. You'll dive into topics like investments, taxation, and risk management, which can get pretty intense, especially if you don’t have a strong math background. If you’re good with numbers and have a knack for understanding financial concepts, you might find it manageable. But if math isn't your thing, you could really struggle. Overall, I'd say it's around average in difficulty—challenging enough to keep you on your toes, but not impossible if you stay organized and put in the effort!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Financial Planning and Services.

When we look at these financial planning graduates and their job histories, it's pretty clear that their earning potential varies widely. For example, someone who graduated from The University of Georgia in 2010 has steadily climbed the ladder into financial advisory roles, indicating a likely comfortable salary—financial advisors can make a decent amount of cash, especially with experience. On the other hand, the graduate from the University of Alabama in 2012 transitioned through multiple unrelated roles before landing in IT, which might not pay as well as a dedicated finance career, suggesting they could be struggling a bit more financially.

Looking across the board, many of these graduates seem to have found stable positions in financial services, which generally offer good earning potential as you gain experience. However, some profiles show early career roles like internships or positions that might not pay exceptionally well, meaning they may still be in the process of building wealth. Overall, it's a mixed bag, but there are definitely a number of folks here who seem to be on a path to making decent money in their careers.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Financial Planning and Services. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Financial Planning and Services (ordered by the average relevance score of their Financial Planning and Services graduates, best to worst) where we have analyzed at least 10 of their graduates: