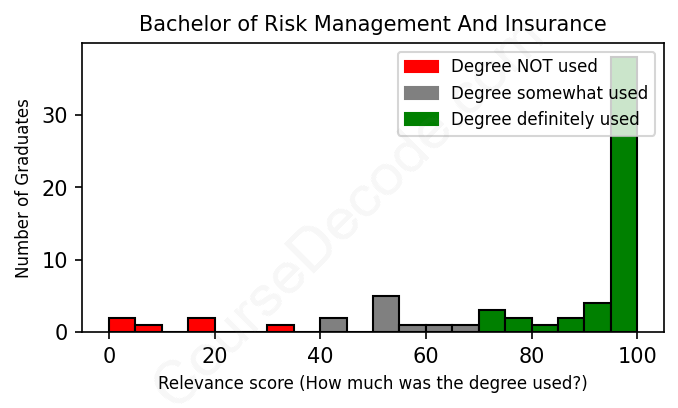

First, some facts. Of the Risk Management And Insurance graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 66 LinkedIn profiles (see below).

The verdict? Significantly above average. Overall, with an average relevance score of 81%, Risk Management And Insurance graduates have a much higher likelihood (+14%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 10% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Risk Management And Insurance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 100% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2021 from University of South Carolina with a Bachelor of Applied Science - BASc in Risk Management And Insurance. No other secondary education since. JOB HISTORY SINCE GRADUATIONAnalyst Lockton Jun 2021 - Jun 2023 Senior Analyst  Lockton Jul 2023 - Present ABOUTNo information provided. |

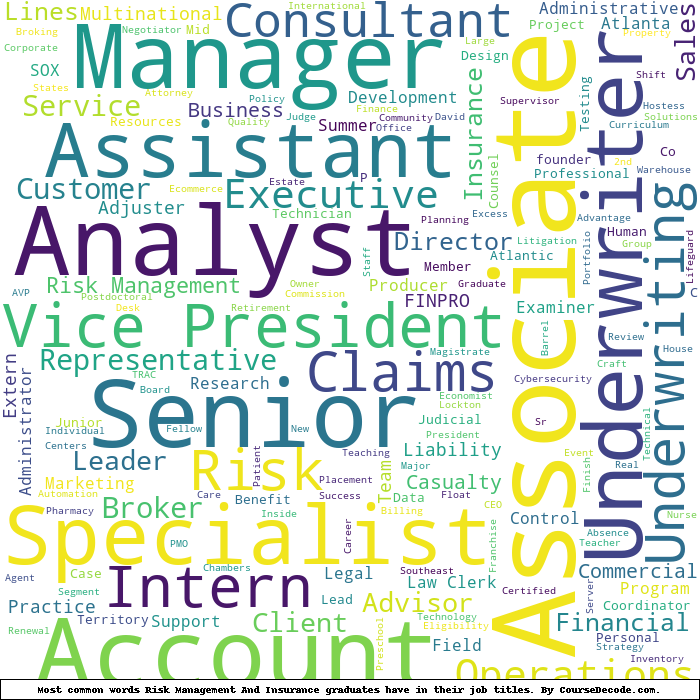

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

Looking at the variety of careers pursued by graduates with degrees in Risk Management and Insurance, we can see that there's a mix of highly relevant roles and some that really don’t connect with what they studied. A consistent pattern is that many of these individuals have landed jobs in areas like underwriting, claims adjusting, and risk analysis, all of which require the skills and knowledge they obtained during their studies. For example, positions like Underwriter and Claims Service Representative are directly aligned with their degree and involve applying risk assessment techniques and insurance principles daily. These roles generally indicate a strong connection to their academic background, suggesting that their education is being directly put to use in these fields.

However, there are also several instances where graduates have taken on roles that aren’t as closely tied to Risk Management and Insurance. Jobs in marketing, sales, or even positions like Customer Service Representative tend to lack the specialized knowledge required in the risk management sector. For instance, a Marketing Director or a Server has skills that might be somewhat transferable, but they don’t tap into the specific training and expertise related to risk assessment or insurance policies. While it's understandable that some people branch out into different fields, this indicates a trend where a significant number of graduates may not be fully utilizing their degree in their chosen paths.

In summary, while there’s a solid representation of graduates working in roles that require a deep understanding of Risk Management and Insurance, there’s also a notable number of individuals in positions that don’t align well with their education. This can be seen as both a strength, showcasing the versatility of the degree, and a weakness, suggesting that not all graduates are finding opportunities that leverage their unique educational background. Ultimately, those in directly related roles are reaping the benefits of their educational investment, while others may find themselves in jobs that aren't maximizing the value of the skills they’ve acquired.

Here is a visual representation of the most common words in job titles for Risk Management And Insurance graduates:

When looking at the career trajectories of graduates in Risk Management and Insurance, it seems that there's a pretty solid foundation in relevant roles, especially for newer grads. Many of those who just graduated recently have stepped into roles like underwriting, risk analysis, and various analyst positions straight out of college. For instance, we see graduates from the University of Georgia and Temple University landing jobs as analysts and account representatives in insurance agencies right away. This is a promising start, suggesting that their education is aligning nicely with available job opportunities in the field.

As we look a bit further down the line, say five to ten years post-graduation, many of these individuals tend to progress into more advanced positions. For example, several graduates began as entry-level analysts or underwriters but have advanced to senior or management positions in companies like Marsh, Aon, and Travelers. There are also graduates who have climbed significantly within their organizations, moving from entry-level roles to VP or executive positions, particularly at places like Acrisure and AmWINS Group. So, it's fair to say that those who remain within the industry generally see growth and advancement.

However, not everyone had a straight shot in these careers—some went off-path or explored different sectors altogether. A few graduates shifted into unrelated roles in marketing or other fields, which can dilute the clear-cut success narrative for risk management majors. This isn’t uncommon, especially in the early career stages where many young professionals are still figuring out what they want. The diversity in roles might indicate that while there are substantial opportunities directly linked to risk management and insurance, some graduates aren't finding their way to those ideal jobs immediately.

In summary, if you're considering a degree in Risk Management and Insurance, the trends suggest that graduates tend to land relevant jobs soon after completing their studies and can expect to rise in their fields over time. However, the path isn't entirely one-size-fits-all, as some take detours into other careers. Overall, it seems like a solid field to get into if you want growth and stability, especially if you're ready to stick with it.

A Bachelor’s degree in Risk Management and Insurance isn’t usually considered super hard, especially when compared to some other majors that dive deep into complex math or dense theories. You’ll definitely have to learn some key concepts and terminology related to risk assessment, policy analysis, and the insurance industry, but the coursework tends to be pretty straightforward and practical. If you’re someone who enjoys problem-solving and has a good grasp of basic math, you’ll likely find it manageable. It may not be a walk in the park, but it generally sits around the easier end of the spectrum for college degrees.

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Risk Management And Insurance.

Looking at these graduates' career paths, it seems like some have really nailed it in terms of making decent money, especially those who ventured into underwriting, consulting, and executive roles. For instance, graduates from reputable schools like the University of Georgia and Temple University have climbed up the ladder into associate director and vice president positions at established companies, which usually come with pretty solid paychecks. It's clear that their early career choices, internships, and connections played a vital role in their financial success.

However, not everyone's journey shows the same level of financial growth. Some profiles indicate more modest roles like customer service or entry-level positions that tend to pay less. This is especially noticeable among more recent graduates who are still figuring things out. Overall, while there's a mix of earnings and career advancement, it seems that those in specialized roles within risk management and insurance are doing well, while others are still on the path to better opportunities.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Risk Management And Insurance. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Risk Management And Insurance (ordered by the average relevance score of their Risk Management And Insurance graduates, best to worst) where we have analyzed at least 10 of their graduates:

| College | Score | Count |

|---|---|---|

University of Georgia - Terry College of Business University of Georgia - Terry College of Business

|

77 | 13 |