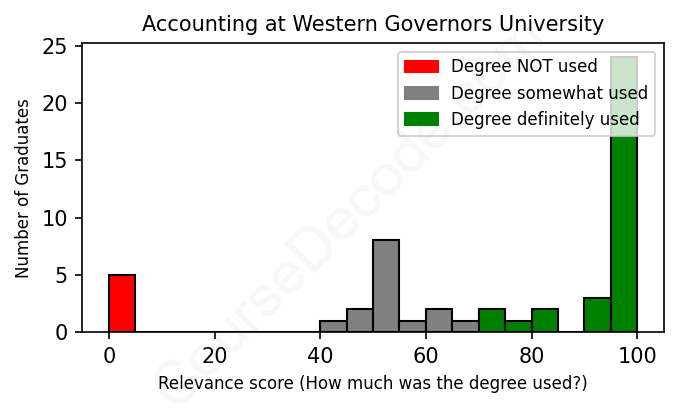

First, some facts. Of the Accounting graduates from Western Governors University we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 52 LinkedIn profiles (see below).

The verdict? Above average. Overall, with an average relevance score of 73%, Accounting graduates from Western Governors University have a higher likelihood (+6%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 13% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Accounting graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 100% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2023 from Western Governors University with a Bachelor's degree in Accounting. No other secondary education since. JOB HISTORY SINCE GRADUATIONFinancial Accountant EARTHWORKS LANDSCAPING SERVICES INC Feb 2023 - Present ABOUTSummary of Qualifications:Recent graduate of the Administrative Professional Program at Davis Technical College.Recent graduate of the Accounting Program at Davis Technical College.Graduate of Clearfield High School and received High School Diploma. Proficient and certified in Microsoft Office Specialist Programs. PowerPoint, Outlook, Word, Excel, OneNoteProficient in Quickbooks |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

After reviewing a variety of LinkedIn profiles of individuals who have graduated with a degree in Accounting from Western Governors University, it’s clear that many of them have landed jobs that reflect a mixed bag of relevance to their educational background. Some have pursued traditional accounting roles, while others have ventured into positions that only tangentially relate to the field or don't use their accounting skills at all. Let's take a closer look at the trends and patterns that emerge from these career paths.

The most common job titles among graduates seem to be Accountant, with many occupying roles such as Staff Accountant, Senior Accountant, and even Accounting Manager. These positions, such as the Accountants at Fishman + Company or DFAS, directly utilize the core accounting principles and practices learned during their degree, making them highly relevant. Other roles like Tax Consultant and Revenue Tax Auditor also stand out. These jobs require in-depth knowledge of tax regulations and financial compliance, which align exceptionally well with the knowledge gained from their accounting education. Essentially, when graduates secure jobs directly titled as 'Accountant' or roles that involve auditing and tax responsibilities, they are utilizing the skills they studied, thus validating their educational investment.

On the flip side, there are a good number of roles that don't require specific accounting knowledge or skills. Positions like Assistant Store Manager at Lowe’s or roles in sales and administration at companies like Health & Safety Institute feel quite disconnected from the rigorous accounting studies. While they might benefit from a general understanding of financial principles, the lack of core accounting tasks renders these positions not particularly relevant for someone with a background in accounting. It’s a bit of a letdown to see graduates taking on roles where their degree isn’t put to good use, especially when they have worked hard to earn it.

Moreover, some roles fall into a gray area where they may involve accounting principles but are not centered on traditional accounting responsibilities. Jobs like Business Manager or Financial Analyst do require analytical skills and some understanding of financial data, but they often veer more into management and strategic planning than pure accounting tasks. While graduates in these roles could argue that their accounting background assists them, the tasks at hand don’t fully align with the detailed study and practice of accounting, making it a bit of a compromise on their expertise.

In conclusion, while many graduates are fortunate enough to land solid accounting roles that leverage everything they've learned, a significant number find themselves in positions where their accounting skills aren't as relevant. This landscape illustrates the mixed outcomes for those with a degree in Accounting from Western Governors University, ranging from fulfilling, relevant positions to roles that underutilize their expertise. Ultimately, it's crucial for these graduates to seek out roles that not only pay the bills but also align more closely with their field of study, allowing them to put their knowledge to impactful use.

Here is a visual representation of the most common words in job titles for Accounting graduates (this is across all Accounting graduates we've analyzed, not just those who went to Western Governors University):

When you look at the career trajectories of graduates from Western Governors University (WGU) who majored in Accounting, a pretty clear picture emerges of where these folks are heading post-graduation. Fresh graduates tend to kick things off with entry-level positions that are closely related to accounting—like accounts payable and staff accountant roles. As you can see from the data, many people started off as staff accountants, accounts receivable clerks, or in various financial analyst roles. This is promising because it shows that most graduates are getting their foot in the door within the field they studied, which is a big deal when you want to build a career in accounting.

Fast forward five or ten years, and it seems like many of these graduates have made some solid strides in their careers. For instance, several individuals moved from entry-level positions to more significant roles, such as internal audit managers, senior accountants, and even financial managers or controllers. This growth trajectory suggests that there’s a good chance of career advancement if you’re putting in the effort. Others have ventured into related fields such as operations or business management, utilizing their accounting skills in broader roles. While not everyone has achieved a perfect linear path within accounting (and some have moved into more general business roles), many have stayed in the finance and accounting space, which shows the degree’s relevance and sustainability in the job market.

On the flip side, some graduates appear to land in roles that are a bit of a stretch from accounting, like management positions in non-accounting-related fields. This might raise some eyebrows, but it does show the versatility of an accounting degree. Even if not everyone sticks strictly to traditional accounting roles, they often leverage their skills in meaningful ways, which could lead to success in other fields. In summary, it seems that WGU accounting graduates generally find good positions relevant to their degree pretty quickly and many build upon those roles over the years, making strides in the finance and accounting world. So, if you’re considering an accounting degree from WGU, the prospects look pretty good!

Getting a Bachelor’s degree in Accounting at Western Governors University (WGU) is generally considered to be pretty manageable, especially if you’re self-motivated. WGU has a unique competency-based learning format, which means you can move through the material at your own pace. If you’re good at staying disciplined and putting in the effort, you could really breeze through it. However, accounting itself can be challenging because it involves a lot of concepts, calculations, and attention to detail, so if you struggle with math or organizing information, it could feel tougher. Overall, if you’re interested in the subject and keep up with the work, you can definitely make it work!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 2 years to finish a Bachelor degree in Accounting.

So, looking at the career paths of these Western Governors University grads, it seems like many of them have landed pretty solid jobs in the accounting and finance field. A lot of graduates have moved into roles like accountants, auditors, and even managerial positions. For example, the person who graduated in 2014 and became an Internal Audit Manager has likely hit a decent salary, especially with that sort of title. Similarly, others who are working as Financial Analysts or Accounting Managers are in roles that usually offer competitive pay.

However, not everyone seems to have climbed the financial ladder that quickly. Some grads started off with temporary or contract positions, while others have roles that might not hit those higher salary brackets, like accounts receivable or support roles. Even though many have experience under their belt now, or have transitioned into specialized positions, the early years in any career can vary widely in terms of income. Overall, while some graduates are likely raking in a good income, others might still be working their way up, so it really depends on the individual paths they’ve taken since graduation.

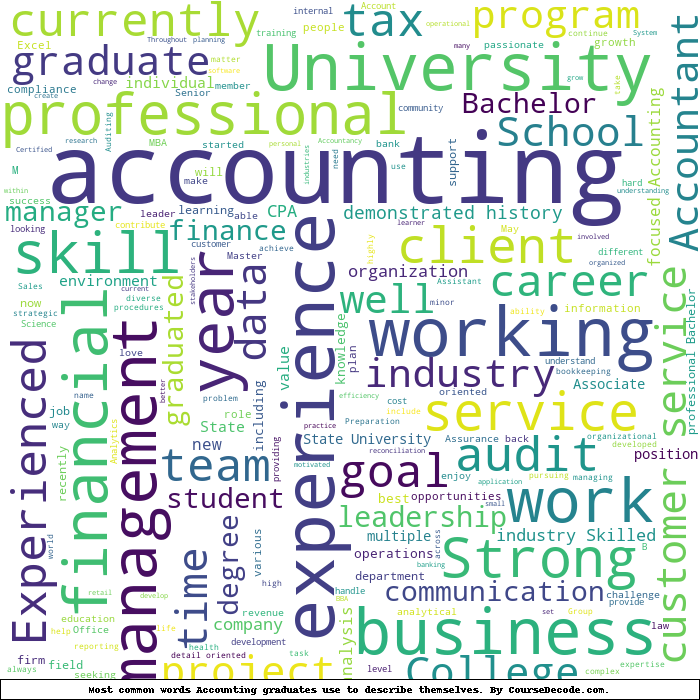

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Accounting (this is across all Accounting graduates we've analyzed, not just those who went to Western Governors University). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Accounting (ordered by the average relevance score of their Accounting graduates, best to worst) where we have analyzed at least 10 of their graduates: