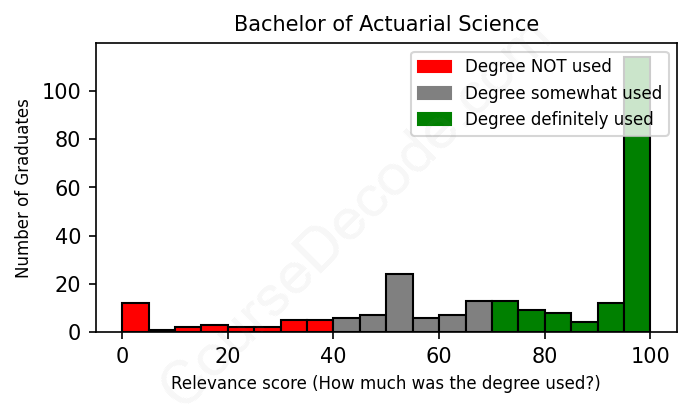

First, some facts. Of the Actuarial Science graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 255 LinkedIn profiles (see below).

The verdict? Above average. Overall, with an average relevance score of 74%, Actuarial Science graduates have a higher likelihood (+7%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 17% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Actuarial Science graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 62% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2018 from University of Saint Thomas with a Bachelor of Science (BS) in Actuarial Science. No other secondary education since. JOB HISTORY SINCE GRADUATIONActuary and Computer Programmer Allianz Life Jan 2018 - Aug 2019 Credit Fraud Rule Quality Analyst  U.S. Bank Aug 2019 - Present ABOUTI am a computer programmer and mathematician/statistician looking to grow my skills and talents to be an invaluable asset to my employer. With my experience in programming, data analytics, and mathematical and statistical analysis and problem solving, I always put forth my absolute best to deliver work that is accurate and of the highest quality. |

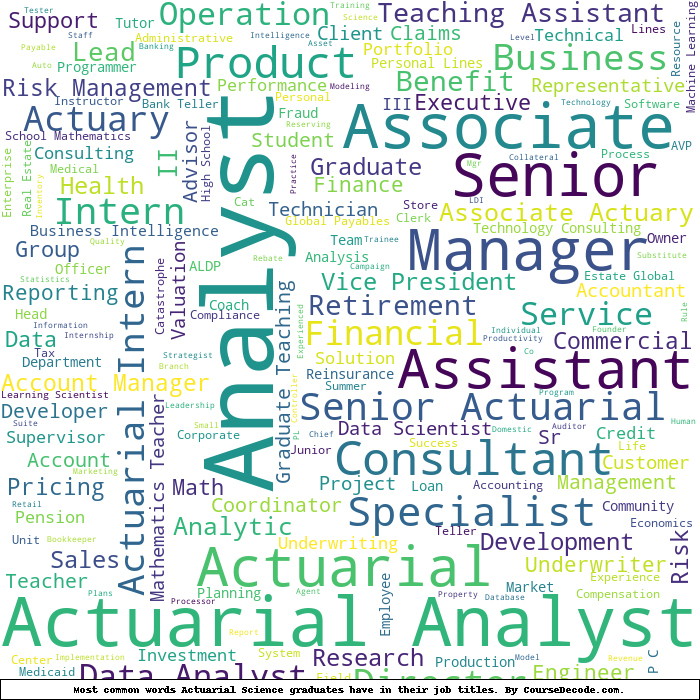

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When diving into the career paths of individuals who have graduated with degrees in Actuarial Science, it's clear that many pursued roles directly aligned with their education while others ventured into seemingly unrelated fields. The most common occupations among this demographic prominently feature Actuarial Analyst and Associate positions, particularly within insurance companies and consulting firms. These roles typically demand substantial expertise in statistical analysis, risk assessment, and financial modeling, skills highly cultivated during their academic training in actuarial science. Many of those who secured jobs as Actuarial Analysts or Consultants at prominent organizations, like Milliman, Deloitte, or Blue Cross, confirm the crucial nature of the knowledge they gained during their studies, emphasizing the direct application of actuarial principles in their daily responsibilities.

However, not all graduates ended up in positions directly tied to actuarial science. Some pursued roles in data analysis, financial analysis, or even sales and marketing. These positions may have utilized analytical skills developed during their education but did not specifically engage in the core actuarial methodologies or risk assessments essential to the field. For instance, roles such as Business Analyst, Marketing Coordinator, or even Teaching positions focused primarily on utilizing broader management or business skills rather than the specialized knowledge from actuarial academia. That said, positions involving data interpretation or financial forecasting maintained a level of relevance due to the quantitative skills they required.

In summary, while a significant portion of Actuarial Science graduates found success in positions that directly leveraged their skills and knowledge, a good number also navigated into roles where their background provided a useful, if not necessary, foundation. Many of these positions still allowed for the application of analytical and quantitative abilities, showcasing the versatility of an actuarial education. Thus, it can be concluded that while the relevance of roles varies widely, the statistical and analytical expertise honed in an Actuarial Science program equips graduates with a valuable toolkit applicable in multifaceted career paths.

Here is a visual representation of the most common words in job titles for Actuarial Science graduates:

When we dive into the career trajectories of graduates with a degree in Actuarial Science, it's clear that many of them find themselves in roles related to their field shortly after graduation. Most of the entries show a strong inclination towards positions like Actuarial Analyst, Actuarial Assistant, or similar roles that leverage the skills they developed during their studies. For instance, graduates from schools like Penn State University and the University of Illinois at Urbana-Champaign often start right into analyst positions, which usually involve a mix of data analysis, risk assessment, and pricing strategy—all core components of actuarial work. This trend is encouraging, as immediate employment in relevant fields supports the idea that these graduates are harnessing their educational background effectively.

Fast forward five to ten years later, and the pathways start to become even clearer. A good number of these individuals transition into senior roles, such as Senior Actuarial Analyst or Actuary, at major companies. For example, a significant number of graduates from reputable institutions like the University of Conncecticut and the University of Wisconsin-Madison have moved up the ranks within respected firms in a relatively short time span. Additionally, there are instances where graduates have shifted into managerial or consultant roles, suggesting a healthy career growth and mobility. However, it’s important to note that not every graduate follows this trend; some find themselves in roles that might seem disconnected from actuarial science or even outside their original career path. For instance, a few individuals ventured into broader data analysis or even unrelated sectors like retail and education.

Overall, while there's a promising trajectory for many Actuarial Science graduates—marked by relevant initial positions and career advancement in the industry—some do struggle to remain within the actuarial realm, which might come off as less successful in terms of their chosen career path. Nonetheless, the degree itself tends to act as a solid foundation, opening doors into various fields of finance, insurance, and data analysis, which can lead to fulfilling careers, regardless of whether they remain strictly within actuarial roles or branch out into related areas.

Honestly, a Bachelor’s degree in Actuarial Science can be pretty challenging, especially if you're not super into math and statistics. You’ll be dealing with a lot of complex concepts like probability, financial mathematics, and risk assessment, which can feel overwhelming if math isn't your strong suit. While some people might find it easier if they have a knack for numbers, for many, it can be a step up from the average degree. It definitely requires dedication, good study habits, and a willingness to tackle some tough subjects, but if you’re up for it and passionate about the field, it can also be really rewarding!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Actuarial Science.

When looking at the LinkedIn profiles of these Actuarial Science graduates, it's pretty clear that a lot of them are doing well financially. Many have progressed from entry-level roles to more senior positions, often within reputable companies in the finance and insurance industries. For instance, graduates with roles like 'Senior Actuarial Analyst,' 'Director,' and 'Partner' typically indicate a significant income growth over time. Even those who have switched careers, like the one who moved from an Actuarial Consultant to a **Registered Nurse**, seem to land well in their new paths, suggesting they are in decent financial situations either way.

That said, some graduates are still in early career jobs, like entry-level actuarial roles or internships, which might not pay as much initially. But considering the strong demand for actuaries and the average salaries associated with these positions, it’s likely many are comfortable enough to start. Overall, if you're eyeing a career in actuarial science, there’s a high chance of earning a solid salary as you climb up the ranks, especially as experience and expertise grow.

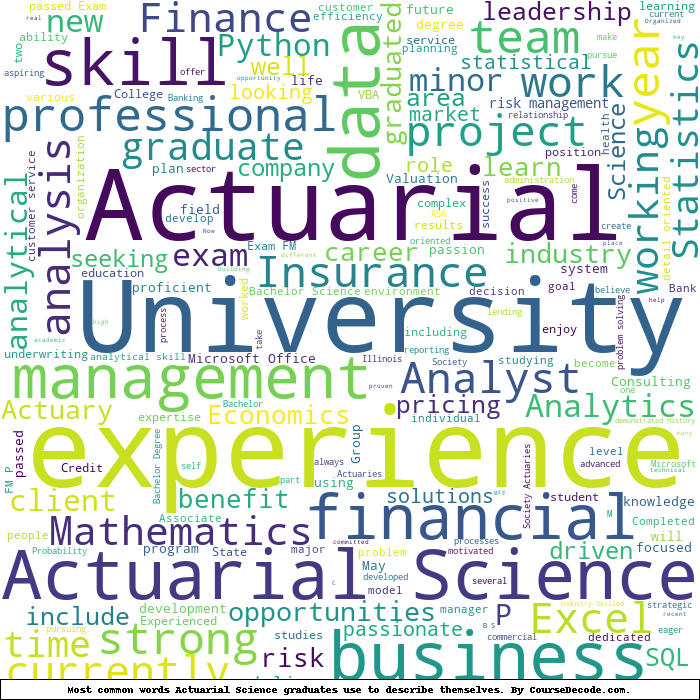

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Actuarial Science. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Actuarial Science (ordered by the average relevance score of their Actuarial Science graduates, best to worst) where we have analyzed at least 10 of their graduates:

| College | Score | Count |

|---|---|---|

Penn State University Penn State University

|

90 | 11 |

University of Illinois at Urbana-Champaign University of Illinois at Urbana-Champaign

|

76 | 11 |