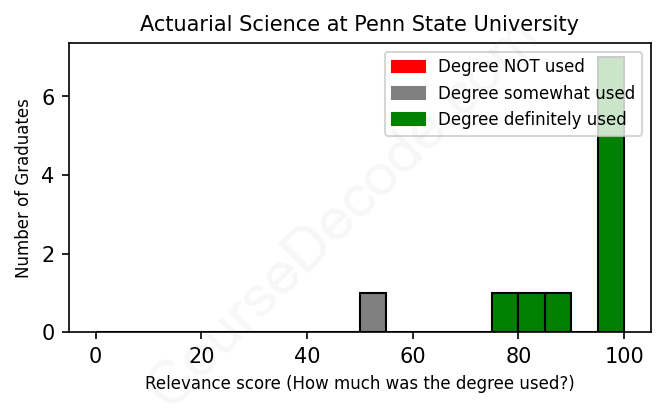

First, some facts. Of the Actuarial Science graduates from Penn State University we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 11 LinkedIn profiles (see below).

The verdict? Great! Overall, with an average relevance score of 90%, Actuarial Science graduates from Penn State University have a substantially higher likelihood (+23%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 27% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Actuarial Science graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 100% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2010 from Penn State University with a Bachelor of Science (B.S.) in Actuarial Science. Also pursued further education since (see below). JOB HISTORY SINCE GRADUATIONSenior Commercial Lines Underwriter Liberty Mutual Insurance Jun 2010 - Oct 2015 Consultant, Product Analysis  Liberty Mutual Insurance Nov 2015 - Dec 2018 Assistant Director, Product Management  Liberty Mutual Insurance Dec 2018 - Jul 2021 Director, Product Solutions  Liberty Mutual Insurance Jul 2021 - Present FURTHER DEGREES DONE SINCE GRADUATINGMaster's DegreeBoston University 2014 - 2015 ABOUTNo information provided. |

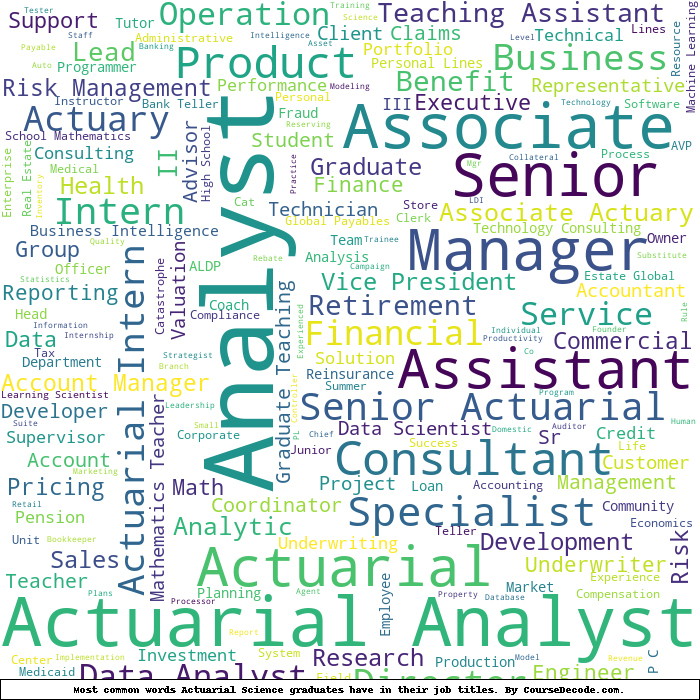

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

So, if we look at the LinkedIn profiles of folks who've graduated with a degree in Actuarial Science from Penn State, we see a variety of job roles, but some common trends definitely pop up. A significant number of the graduates have landed roles in insurance and risk management, particularly at companies like Liberty Mutual and Prudential Financial. Positions such as Actuary, Analyst, or Underwriter are pretty typical, where actuarial knowledge is crucial. These jobs involve analyzing risks, calculating premiums, and applying statistical methods—basically, all stuff you dive into during the degree program. This direct link to actuarial science shows how valuable the degree is in these industries.

On the flip side, not every job on this list fits neatly within the actuarial realm. Some graduates have taken paths like business system analysis or various roles in operations and compliance that only touch on the analytical skills gained from an actuarial background. While those jobs can use similar skills—like analytical thinking or risk assessment—they often don’t require the full depth of actuarial expertise. So, overall, while there’s a strong trend leaning towards jobs that are very relevant to their degree, there are also those who veered into adjacent fields where their actuarial skills come in handy but aren’t the main focus. It just goes to show that a degree in actuarial science opens a lot of doors, not all of which lead directly into traditional actuarial roles!

Here is a visual representation of the most common words in job titles for Actuarial Science graduates (this is across all Actuarial Science graduates we've analyzed, not just those who went to Penn State University):

Overall, graduates from Penn State University's Actuarial Science program seem to be on a solid career path, especially in the insurance and consulting sectors. Many of them land first jobs as actuarial analysts, underwriters, or in related roles shortly after graduation, typically within companies that are tied directly to the financial and insurance industries. For instance, graduates from 2010 and 2011 have progressed through various roles at Liberty Mutual and Vanguard, respectively, showcasing a natural upward movement within their organizations. This suggests that their first jobs are not just stepping stones but rather foundations for long-term careers.

If we look at their careers five or ten years down the line, a lot of these individuals end up in managerial or director positions, further emphasizing the value of their degree. For example, a graduate from 2013 who began as a Senior Actuarial Associate quickly climbed to a Corporate Vice President at major financial firms. Another graduate transitioned from an entry-level analyst role to becoming a lead associate and now manages retirement benefits. This consistent trend indicates that not only are graduates finding relevant jobs after college, but they are also advancing in their careers, which is a testament to the quality of the education and the demand for actuarial professionals in the job market. In summary, if you're considering pursuing a degree in Actuarial Science at Penn State, it appears to lead to promising, rewarding career opportunities!

Hey there! So, a Bachelor’s degree in Actuarial Science at Penn State University is generally considered pretty challenging. It’s a blend of advanced math, statistics, and finance, which means you’ll be dealing with a lot of complex concepts that require strong analytical skills. The coursework can get pretty intense, especially when you dive into classes like probability theory and financial mathematics. That said, if you enjoy math and are willing to put in the effort, it can be a rewarding experience. Just be prepared to study hard and maybe even pull a few late nights with textbooks and problem sets!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Actuarial Science.

Based on the career trajectories of these Penn State Actuarial Science grads, it looks like they've mostly landed some pretty solid jobs, which is a good indicator that they’re making decent money. The ones who started at big companies like Liberty Mutual, Prudential, and Deloitte seem to have climbed the corporate ladder, snagging promotions and stepping into higher roles, which usually comes with a nice pay bump. Even those who started out in more entry-level roles in analytics or client support have moved into senior positions, suggesting they’re probably earning good salaries now. Overall, it seems like they’ve done well for themselves financially, especially compared to your average entry-level salary!

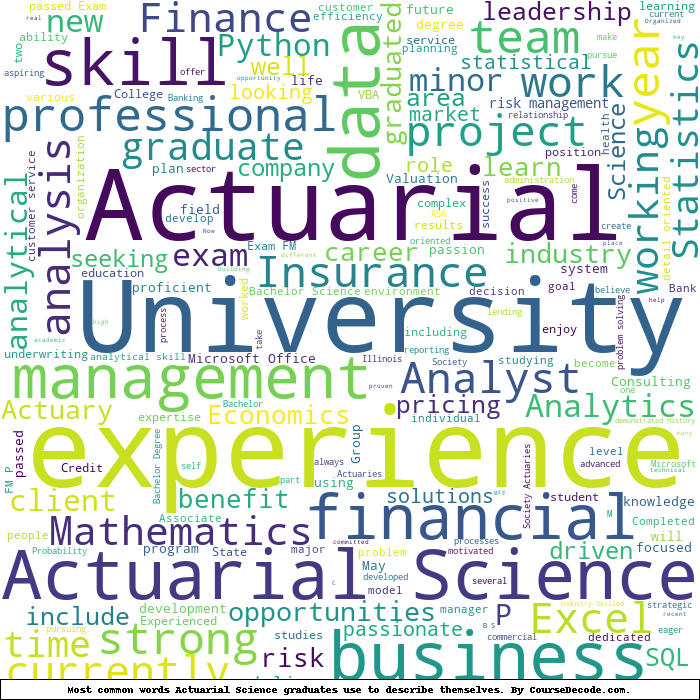

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Actuarial Science (this is across all Actuarial Science graduates we've analyzed, not just those who went to Penn State University). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Actuarial Science (ordered by the average relevance score of their Actuarial Science graduates, best to worst) where we have analyzed at least 10 of their graduates:

| College | Score | Count |

|---|---|---|

Penn State University Penn State University

|

90 | 11 |

University of Illinois at Urbana-Champaign University of Illinois at Urbana-Champaign

|

76 | 11 |