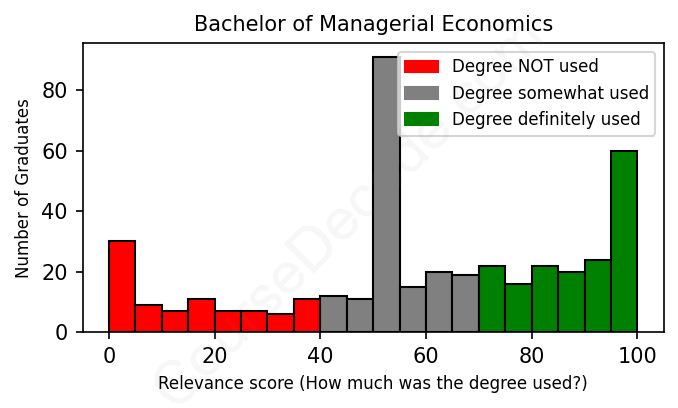

First, some facts. Of the Managerial Economics graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 420 LinkedIn profiles (see below).

The verdict? Below average. Overall, with an average relevance score of 59%, Managerial Economics graduates have a lower likelihood (-8%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 25% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Managerial Economics graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 50% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2013 from University of California, Santa Cruz with a Bachelor of Arts (B.A.) in Managerial Economics. No other secondary education since. JOB HISTORY SINCE GRADUATIONMobile Sales consultant Best Buy 2013 - 2014 ABOUTNo information provided. |

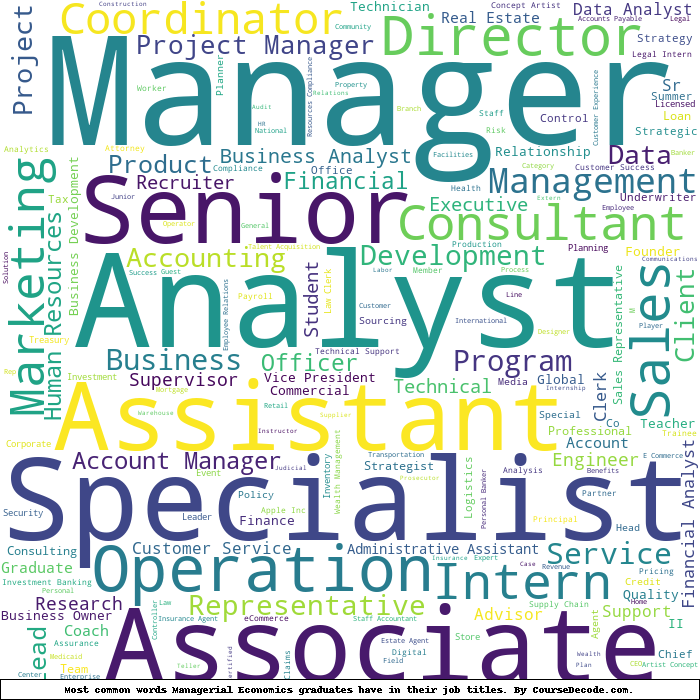

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

From my analysis of various LinkedIn profiles of individuals who graduated with degrees in Managerial Economics, I've noticed some common job patterns and varying degrees of relevance between those jobs and the skills they'd typically gain through their education. Most graduates from this field tend to find employment in roles that involve economics, data analysis, and managerial responsibilities, reflecting the practical applications of their studies. However, many also wander into areas that might not utilize their education as fully as one might expect.

Among the most prevalent job titles I've observed include positions such as financial analysts, marketing managers, and account managers. Each of these roles typically benefits from skills honed in a Managerial Economics program, like data analysis, economic reasoning, and strategic decision-making. Positions like financial analyst and marketing manager are particularly relevant as they directly apply economic principles in assessing market conditions or managing budgets. On the flip side, positions in customer service, sales, or even some teaching roles might include some useful soft skills but generally lack direct relevance to Managerial Economics principles. For instance, jobs like being a server or even a logistics coordinator may draw on general business acumen, but don’t fully tap into the analytical tools and economic theories learned throughout the degree.

Some jobs even appear unrelated altogether. Fields such as creative arts, hospitality service roles, and certain legal positions, while they may benefit from organizational and analytical strategies, do not consistently rely on the economic theories or quantitative analysis that the degree emphasizes. Roles in art design or as a legal consultant, for example, focus more on niche skills that stray far from the core competencies of Managerial Economics. The mismatch in expectations highlights a broader concern among graduates about effectively leveraging their education in the workforce.

In summary, the job market for individuals with a degree in Managerial Economics is wide-ranging, with many inhabitants falling into relevant positions that align well with their education. Yet, it’s also peppered with exits into roles that either do not fully utilize the skills acquired or veer away from the core competencies associated with Managerial Economics. Ultimately, it reflects a mixed landscape where graduates must sometimes navigate away from their training to carve out a niche in the workforce.

Here is a visual representation of the most common words in job titles for Managerial Economics graduates:

When looking at the career trajectories of graduates in Managerial Economics, it’s clear there’s quite a mix of success stories, particularly in the early stages post-graduation. Most graduates land roles that are closely aligned with economics and management principles. For instance, many of these graduates, right after college, kick off their careers in positions like analysts, associates, assistant managers, and various entry-level jobs in finance, consulting, and business management. This suggests that a degree in Managerial Economics opens up quite a few doors for fresh graduates, allowing them to begin their professional careers in relevant fields.

Fast forward five years after graduation, and there’s a noticeable variation in outcomes. While some graduates have successfully climbed up the corporate ladder and transitioned into roles like senior managers, directors, or specialized analysts in finance, marketing, or consultancy, others have taken less traditional paths—such as founding their companies or branching into entirely different sectors. For example, a graduate who started as an analyst might now be a senior product manager or a business owner, demonstrating how flexible the skills acquired from a Managerial Economics degree can be. However, there are also individuals whose career paths seem less aligned with their degrees, perhaps entering industries like operations or customer service roles that don’t directly reflect their academic training.

Looking ten years ahead, the trajectory continues to show diversification. Some individuals are now in significant leadership positions, such as department heads or operational directors for major companies, which is a promising indicator of the degree’s relevance and utility. However, others still appear stagnated in less impactful positions or have pivoted into roles far from economics, such as teaching or creative sectors. This divergence lays bare the varied paths that such a degree can lead to following graduation—a mix of success and challenges, driven by individual choices and economic circumstances.

Overall, if there’s a takeaway from this analysis, it’s that a degree in Managerial Economics tends to provide solid foundational skills applicable in many industries. While a good number of graduates are successful in careers that reflect their education, there remains a segment that navigates a different landscape, suggesting that while the degree is valuable, personal ambition and adaptability are key factors influencing long-term career success.

Honestly, a Bachelor's degree in Managerial Economics can be a bit of a mixed bag when it comes to difficulty. It generally sits somewhere around the average level compared to other business-related degrees, but it has its challenging moments, especially with classes in microeconomics, statistics, and financial analysis. If you're good with numbers and enjoy problem-solving, you'll probably find it manageable, but if math isn't your strong suit, you might struggle a bit more. Overall, it’s definitely doable, but it requires some commitment and effort—just like any college degree!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Managerial Economics.

Looking at the careers of these various managerial economics graduates, it seems there's a pretty mixed bag when it comes to their earnings. Some like the graduate from UCLA in 2012, who moved up the ladder at KPMG to a Senior Manager and then a Director at AEye, definitely appear to be making decent money. Similarly, the person who graduated from Penn State in 2016 seems to be doing well with multiple partnerships and a growing business. On the contrast, many of the graduates are working in roles that are lower on the pay scale, like those in administrative or entry-level positions that don't typically lead to high salaries, at least to start with.

For the University of California, Davis graduates, several have taken on roles that may provide a solid income, especially those in data analytics or finance. However, positions like teaching assistants or some lower-tier roles in customer service indicate that not everyone is raking in good money right off the bat. The variations really highlight that while some graduates are in positions that likely pay well, others are still working their way up or might not have landed the lucrative jobs they might've been hoping for right after graduation. So in summary, while some are definitely on the right track toward comfortable incomes, others might still be navigating their career paths to find better financial opportunities.

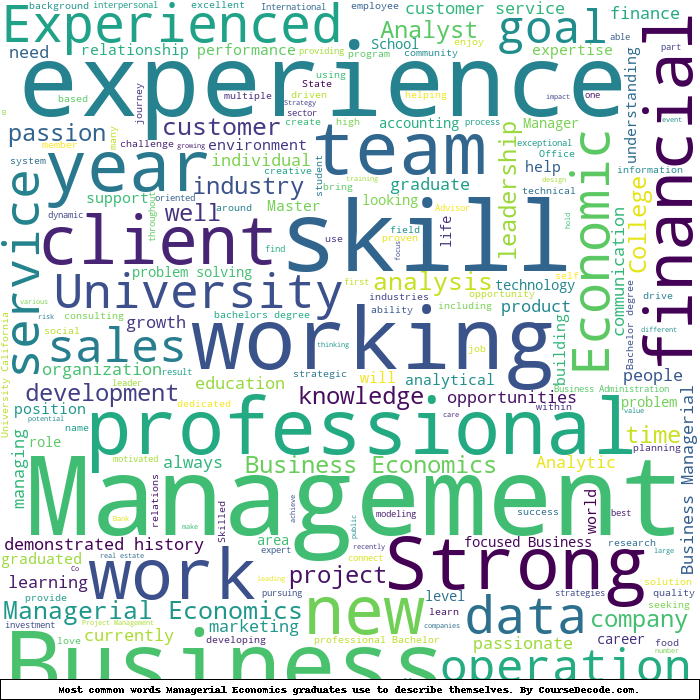

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Managerial Economics. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Managerial Economics (ordered by the average relevance score of their Managerial Economics graduates, best to worst) where we have analyzed at least 10 of their graduates:

| College | Score | Count |

|---|---|---|

University of California, Los Angeles University of California, Los Angeles

|

76 | 12 |

University of California, Riverside University of California, Riverside

|

68 | 14 |

University of California, Davis University of California, Davis

|

66 | 44 |

State University of New York College at Cortland State University of New York College at Cortland

|

61 | 11 |

UC Irvine UC Irvine

|

55 | 27 |