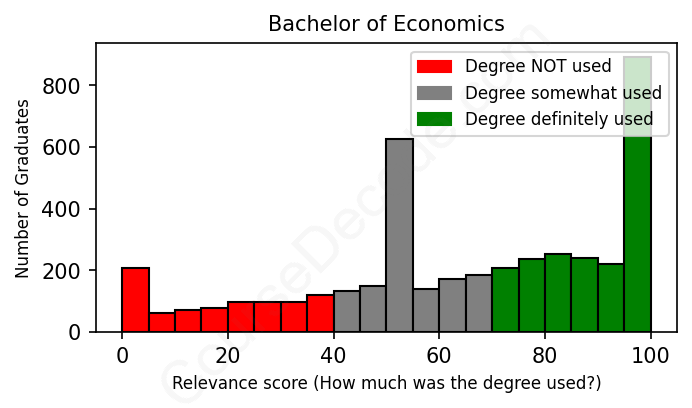

First, some facts. Of the Economics graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 4291 LinkedIn profiles (see below).

The verdict? Slightly below average. Overall, with an average relevance score of 63%, Economics graduates have a slightly lower likelihood (-4%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 34% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Economics graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 92% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2022 from Northwestern University with a Bachelor's degree in Economics. Also pursued further education since (see below). JOB HISTORY SINCE GRADUATIONIntern Cresa Chicago Mar 2022 - Jun 2022 Investment Analyst  Marc Realty Apr 2023 - Present FURTHER DEGREES DONE SINCE GRADUATINGMaster's degreeNorthwestern University 2022 - 2023 ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When looking at the job trajectories of individuals who have graduated with a degree in Economics, it's evident that there are common patterns around the types of positions people take on after their studies. The most frequent roles seem to land within finance and banking, especially in areas such as financial analysis, investment banking, and client relations. Many also find their footing in various consulting roles, where they leverage their analytical skills to assist businesses in strategy and operations. This trend reflects the analytical nature of Economics, equipping graduates with the ability to navigate complex financial systems and undertake analytical tasks that are highly valued in sectors like finance and consulting.

However, not all positions secured by Economics graduates are directly aligned with their field of study. A clear division can be observed between jobs that are highly relevant to Economics, such as financial analysts, economists, or investment consultants, and those where the relevance is more indirect or minimal, such as in sales, retail management, or administrative roles. For instance, while a financial analyst directly applies economic principles in data and market analysis, a sales associate at a retail outlet does not engage in any significant economic analysis, instead focusing on customer service skills that might not require an economics background. This dichotomy illustrates that while the foundational knowledge gained from an Economics degree is valuable, many students end up in roles where Economics is not explicitly utilized, reflecting a broader employment landscape that isn't strictly tied down to any single field.

In conclusion, while many graduates with a degree in Economics find themselves in roles that directly relate to their field—especially within finance and consulting—there is also a substantial number who venture into areas that utilize some economic principles but prominently feature other skills. The relevance of their degree often becomes a multi-faceted journey, emphasizing the importance of transferable skills and adaptability in today’s job market.

Here is a visual representation of the most common words in job titles for Economics graduates:

When we take a look at the career trajectories of Economics graduates from various universities, there's a diverse range of paths these individuals have taken post-graduation. Many seem to kick start their careers in positions that are fairly related to economics, finance, or analytics, which is a positive sign. For example, roles like financial analysts, economic consultants, and operations managers are prominent as initial jobs. This suggests that these graduates are successfully leveraging their Economics degrees to land roles that are relevant to their field of study right after graduation.

Fast forward five to ten years later in their careers, and we see several themes emerging. Many of these individuals transition into higher-level positions, such as senior analysts, managers, or even directors, often within the finance or consulting sectors. This pretty much indicates a typical upward trajectory in the corporate ladder, where they build upon their experience and take on more complex responsibilities. However, there are also those who appear to navigate away from traditional economics-related careers into fields that might not utilize their Economics background as effectively, such as teaching or general management in unrelated sectors. This dilution in the relevance of their degrees could be seen as a downside for some, highlighting that not every graduate remains within their field of study as they progress through their careers.

On the other hand, some graduates remain very much tied to their field, with many advancing into prestigious firms or becoming partners and directors in financial services and consulting companies. This shows that there's potential within the economics discipline for considerable growth and success. Nonetheless, a portion of the graduates drift into positions that don’t align perfectly with Economics, whether that’s through a change in interests or market demands, painting a more ambiguous picture of job satisfaction and relevance. Overall, we see that Economics graduates generally tend to start their careers on solid footing but may not always sustain that trajectory in terms of relevance to their degree over time.

Honestly, a Bachelor’s degree in Economics can be a bit of a mixed bag when it comes to difficulty, kind of like most majors. It’s definitely not the easiest path out there, but it’s also not the most brutal. You’ll find yourself diving into concepts like microeconomics, macroeconomics, statistics, and calculus, which can be challenging, especially if math isn’t your strong suit. If you enjoy problem-solving and can handle some number-crunching, you might find it interesting rather than overwhelming. Overall, I'd say it requires a good amount of dedication and critical thinking, but it's totally manageable with some effort!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Economics.

Looking at all these economics graduates and their career paths, it's pretty clear that many of them are doing quite well for themselves financially. Those in more technical fields like finance, consulting, and investment banking generally secure lucrative positions early on, especially graduates from top universities like Harvard or the University of Pennsylvania. For example, graduates working as analysts and associates at firms like Goldman Sachs and JPMorgan are likely making some serious bank right out of school.

On the other hand, some graduates have taken paths that may not be as financially rewarding, like teaching or administrative roles, which typically have lower starting salaries. Additionally, the time it takes to move up the ladder in certain industries can delay significant earnings. In general, though, if they stick with their careers and build their skills, most economics graduates have good potential for solid salaries in the long run, but it can vary widely depending on the industry and the individual choices they make.

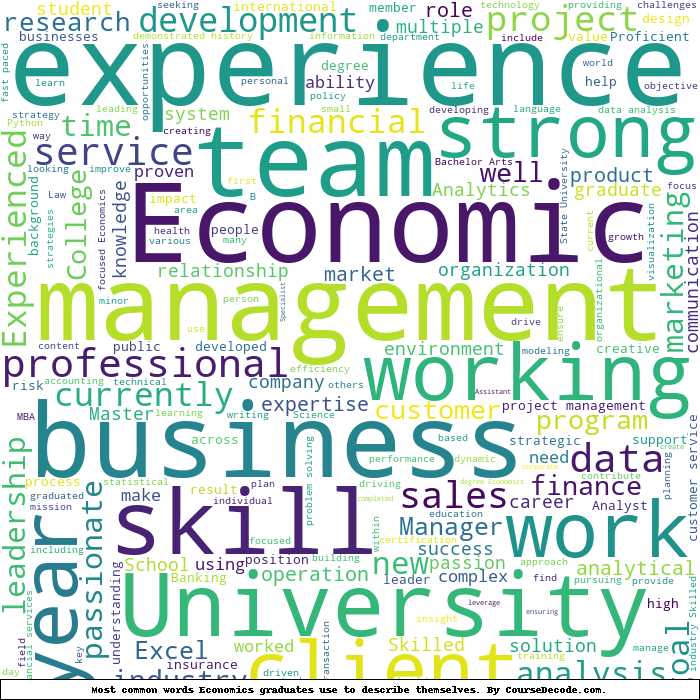

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Economics. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Economics (ordered by the average relevance score of their Economics graduates, best to worst) where we have analyzed at least 10 of their graduates: