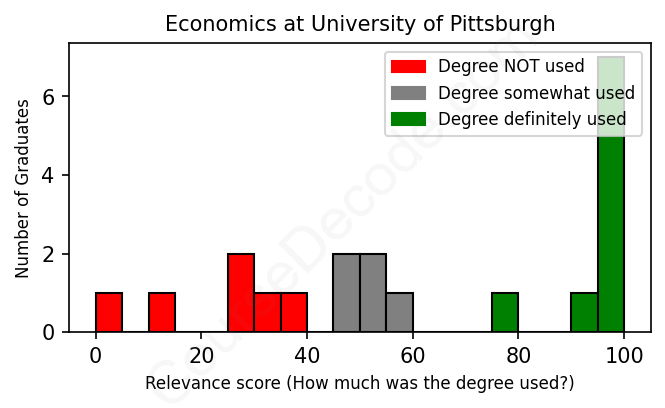

First, some facts. Of the Economics graduates from University of Pittsburgh we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 20 LinkedIn profiles (see below).

The verdict? Slightly below average. Overall, with an average relevance score of 62%, Economics graduates from University of Pittsburgh have a slightly lower likelihood (-5%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 30% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Economics graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 90% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2013 from University of Pittsburgh with a Bachelor of Science in Economics. No other secondary education since. JOB HISTORY SINCE GRADUATIONTreasury Operations Analyst BNY Mellon Nov 2013 - May 2014 Tax and Documentation Clerk  BNY Mellon Jun 2014 - Jun 2015 Logistics Coordinator  PLS Logistics Services Nov 2015 - May 2016 Account Analyst  BNY Mellon May 2016 - Jan 2017 Commercial Loan Specialist II  Citizens Bank Mar 2017 - Sep 2019 Credit Risk Consultant  Cobblestone Management, LLC Oct 2019 - Jan 2020 Credit Officer  Lendbuzz Jan 2020 - Jun 2021 Senior Loan Officer  Lendbuzz Jun 2021 - Jan 2023 Senior Loan Officer and Product Expert  Lendbuzz Jan 2023 - Present ABOUTExperienced business-banking professional with proven success in managing strategic relationships, driving new processes and delivering revenue-backed results. Extensive knowledge in commercial credit sectors backed by experience and certified training in Moodys Analytics and GARP.Specialties:- Credit Risk Analysis- Credit Management- Risk Assessment- Operations Analysis- Credit Consulting- Process Development |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

From the analysis of LinkedIn profiles of Economics graduates from the University of Pittsburgh, it's clear that many of them have ventured into diverse roles across various industries, but not all of these positions are directly related to their academic field. The most common types of jobs seem to cluster around customer success and relationship management roles, which, while they may benefit from an understanding of market dynamics, do not necessitate deep economic knowledge. Positions like Customer Success Manager and various representative roles dominate, where the focus is more on client interactions and service rather than applying economic theories or principles. In contrast, there are also significant positions in finance, such as Financial Analysts, Loan Officers, and Analysts in brokerage firms, where the application of economics is much more pronounced and crucial to the job function.

Overall, the relevance of these jobs to an Economics degree is mixed. While some roles, particularly in finance and real estate, effectively leverage economic concepts and analytical skills, many others lean towards areas like marketing, customer service, or operations, where economic knowledge might play a supportive but not essential role. In short, graduates are finding work that spans the spectrum from highly relevant to tangentially related, reflecting the versatility of an Economics degree but also indicating that not all job placements fully tap into the specialized training the graduates received.

Here is a visual representation of the most common words in job titles for Economics graduates (this is across all Economics graduates we've analyzed, not just those who went to University of Pittsburgh):

When you look at the career trajectories of graduates from the University of Pittsburgh with an Economics degree, it seems like there’s a good mix. For many, the first job right out of college tends to be in customer service, sales, or entry-level positions in finance or analytics. For example, graduates from 2010 and 2013 often started in roles like admissions representative or treasury operations analyst, which aren't exactly what you might picture when you think of an Economics degree, but they do help build valuable skills. Over time, many of these graduates appear to find their way into more relevant fields, with several moving into financial analysis, data analytics, or customer success management roles within five to ten years.

Looking at the paths over the longer term, a notable number have advanced to positions in financial services and analysis or in managerial roles within companies, especially those that align with economics like banking, asset management, or even consulting. For example, a 2015 graduate is currently an Assistant Vice President at Marsh, which is quite impressive. However, there are also some graduates who veered off into unrelated sectors or seemed to float between roles in sales or marketing, which suggests that not every graduate finds a straight path directly aligned with economics. So while many are doing well and landing relevant jobs that leverage their degree, there’s a clear indication that others may take a bit longer to settle into roles that truly align with their education. Overall, it’s a mixed bag, but definitely a solid foundation for those looking to build meaningful careers down the road.

Hey! So, getting a Bachelor’s degree in Economics can be a bit of a mixed bag, and the University of Pittsburgh is no exception. Generally speaking, I’d say it’s moderately challenging. You’ll definitely have to tackle some pretty tough math and statistics, especially if you’re diving into the more advanced stuff like econometrics. Plus, understanding economic theories and models can take some serious brainpower. However, if you’re interested in the subject and willing to put in the effort, it’s totally manageable. Most students find it a bit more rigorous than, say, a degree in communications or history, but it's not the hardest thing out there either. Just stay organized, ask for help when you need it, and you'll likely do just fine!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Economics.

Looking at these Economics grads from the University of Pittsburgh, it seems like most of them have made some decent money over the years, especially as they've advanced in their careers. Positions like "Senior Associate" at J.P. Morgan, "Assistant Vice President" at Marsh, and "Senior Loan Officer" at Lendbuzz suggest a solid paycheck, and even those starting out in customer success roles or financial advising positions are likely pulling in respectable salaries given the industry standards. However, you’ve also got some folks starting out in more entry-level gigs or doing temporary work, which can definitely drag down the overall average. Still, overall, it appears that many of these graduates have found paths that can lead to financial stability with time and experience.

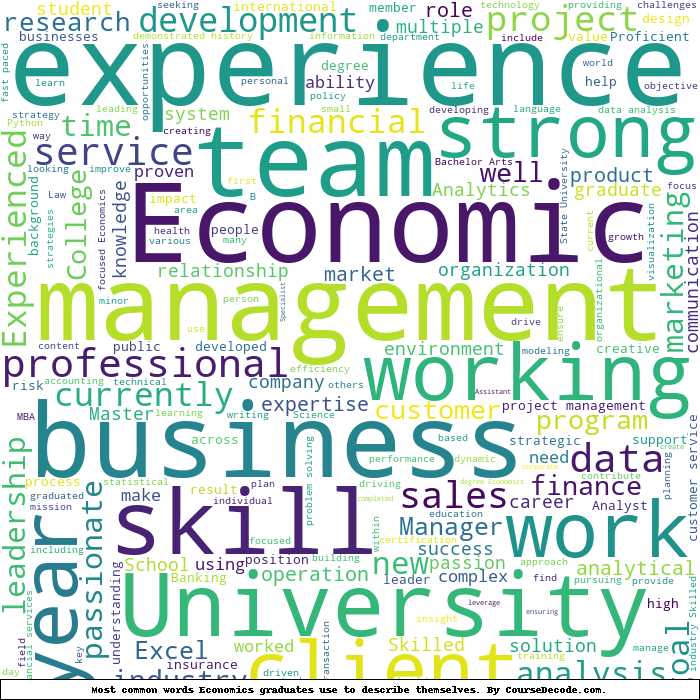

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Economics (this is across all Economics graduates we've analyzed, not just those who went to University of Pittsburgh). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Economics (ordered by the average relevance score of their Economics graduates, best to worst) where we have analyzed at least 10 of their graduates: