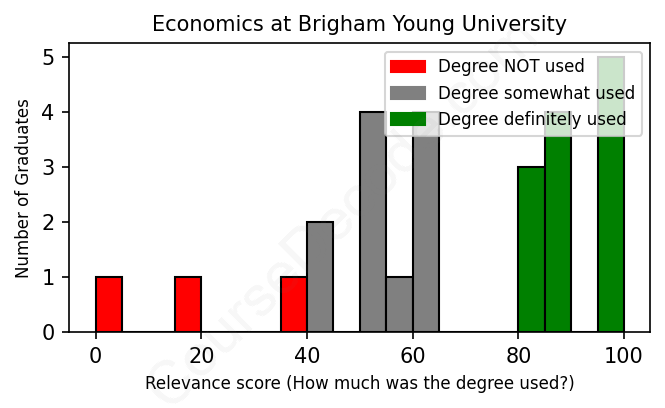

First, some facts. Of the Economics graduates from Brigham Young University we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 26 LinkedIn profiles (see below).

The verdict? On par with the average. Overall, with an average relevance score of 67%, Economics graduates from Brigham Young University have about the same likelihood of finding work in this field as the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 30% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Economics graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 81% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2021 from Brigham Young University with a Bachelor of Science - BS in Economics. No other secondary education since. JOB HISTORY SINCE GRADUATIONResearch Assistant Brigham Young University May 2021 - Dec 2022 Actuarial Analyst  Providence Health Plan Jan 2022 - Jan 2024 Actuarial Analyst II  Select Health Jan 2024 - Present ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When looking at the job trajectories of Economics graduates from Brigham Young University, it's clear that many have gravitated toward roles in finance and analytical positions. Jobs like Financial Analysts and Finance Managers at various companies, including Park City Municipal Corporation and Amazon Web Services, dominate the landscape, showcasing a strong connection to the skills and principles taught in their degree program. Additionally, positions like Actuarial Analyst and Data Scientist also highlight the statistical and analytical skills that Economics programs tend to emphasize. This suggests that graduates are generally able to find roles that directly relate to their studies, especially in finance and data analysis, which call upon their knowledge of economic theories and practical applications.

However, it’s also notable that not all positions clearly relate back to an Economics degree. Some graduates end up in management, sales, or administrative roles where their economics education may enhance their understanding but isn't strictly necessary for the job. For instance, roles such as District Sales Manager or even a Tumbling Instructor diverge significantly from core economics principles. Overall, while many graduates manage to secure relevant positions utilizing their economics backgrounds, a fair number find themselves in jobs where their degree's relevance is more peripheral. So, it’s a mixed bag; some are right on target with their economics background, while others take a more indirect route that doesn’t fully capitalize on their education. This highlights the versatility of an Economics degree, even if some paths veer away from direct application of economic concepts.

Here is a visual representation of the most common words in job titles for Economics graduates (this is across all Economics graduates we've analyzed, not just those who went to Brigham Young University):

Graduates from Brigham Young University with a degree in Economics have generally found themselves on promising career trajectories that align well with their field of study. Right after graduating, many kick off their careers in finance-related roles, like financial analysts or financial advisors. This makes sense since they’ve likely built a solid foundation in economic principles and financial analysis during their studies. For instance, you’ll notice several grads starting as financial analysts or other entry-level positions in finance, which provides them valuable industry experience and sets the stage for upward mobility. These first jobs typically happen within a couple of years post-graduation, as demonstrated by many individuals moving from junior roles to management positions relatively quickly.

Fast forward five to ten years, and you'll see these graduates transitioning into mid to senior-level roles, such as finance managers, directors, or even product marketing managers. The data shows a mix of individuals sticking within finance—climbing the corporate ladder at companies like Amazon Web Services and Fisher Investments—and those branching into other fields like healthcare and data science. While some have ventured off the traditional path, the overall trend is that a significant number end up in solid positions that utilize their economics background effectively. So, if you study Economics at BYU, you’re likely looking at a future with plenty of options in the job market, often leading to successful and relevant careers.

Getting a Bachelor’s degree in Economics at Brigham Young University can be a bit of a mixed bag—it’s not the easiest degree out there, but it's not the hardest either. You’ll be diving into some tough concepts like microeconomics, macroeconomics, and statistics, which can definitely be challenging if math isn’t your strength. But if you’re into analytical thinking and enjoying problem-solving, it can be really rewarding too. Overall, it tends to require consistent effort and a good grasp of math, but if you’re motivated, you can totally handle it! Just make sure to keep your study schedule on point and don't be afraid to ask for help when you need it.

Most commonly, in the LinkedIn profiles we've looked at, it takes people 5 years to finish a Bachelor degree in Economics.

Alright, so looking at these BYU Economics grads, it seems like a mixed bag when it comes to their earnings potential. The ones who got into finance and tech (like those at Amazon and Fisher Investments) are likely pulling in some decent bucks, especially as they move up to managerial roles or specialized positions, which usually come with nice paychecks. On the other hand, some folks took paths that seem less lucrative, like fostering or volunteering, which probably aren't cash cows. Overall, while there's definitely a range, many of these graduates have landed in roles that should enable them to make a solid living, especially over time as they gain experience and climb the career ladder. So, it looks like they’re doing alright financially, but it all depends on the specific field and how they progress!

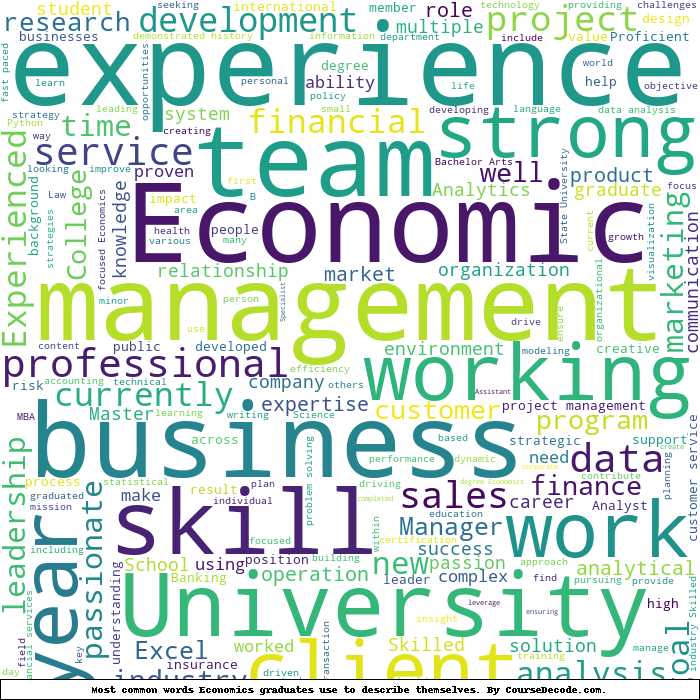

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Economics (this is across all Economics graduates we've analyzed, not just those who went to Brigham Young University). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Economics (ordered by the average relevance score of their Economics graduates, best to worst) where we have analyzed at least 10 of their graduates: