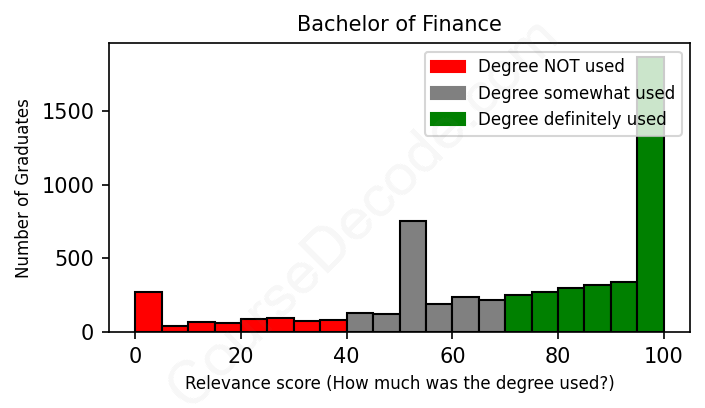

First, some facts. Of the Finance graduates we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 5780 LinkedIn profiles (see below).

The verdict? Slightly above average. Overall, with an average relevance score of 70%, Finance graduates have a slightly higher likelihood (+3%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 23% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 100% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2022 from University of Oregon with a Bachelor's degree in Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONFinancial Advisor Northwestern Mutual Jun 2022 - Jan 2024 Financial Advisor  SCS Jan 2024 - Present ABOUTPassionate Financial Advisor | Wealth Management Specialist | Committed to Helping Clients Achieve Financial Success About Me:As a Financial Advisor, my mission is to empower individuals and families to achieve their financial goals and secure their future. With a strong background in wealth management, I specialize in creating personalized strategies that align with each client's unique aspirations and circumstances. Expertise:I have successfully guided clients through various market conditions, helping them build and preserve wealth. My areas of expertise include investment planning, retirement strategies, estate planning, and risk management. Approach:I believe in fostering long-term relationships based on trust, transparency, and a deep understanding of my clients' financial objectives. By staying current with market trends and leveraging cutting-edge financial tools, I ensure that my clients receive strategic advice tailored to their evolving needs. Commitment to Excellence:I am dedicated to maintaining the highest standards of professionalism. I am committed to continuous learning, staying informed about industry innovations, and adapting strategies to optimize returns while managing risks effectively. Let's Connect:I am always eager to connect with individuals seeking financial guidance or exploring opportunities for wealth creation. Whether you are planning for retirement, growing your investment portfolio, or navigating complex financial decisions, I am here to assist you on your journey to financial success.Let's connect and explore how we can work together to achieve your financial goals!#FinancialAdvisor #WealthManagement #InvestmentStrategies #RetirementPlanning #EstatePlanning #FinancialSuccess |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

The analysis of job titles held by graduates in Finance reveals a spectrum of roles across various industries, illustrating how finance degrees can both directly and indirectly influence career paths. Many graduates have successfully transitioned into positions that utilize their specific skills in financial analysis, risk management, and investment strategies, showcasing the importance of a finance education in today’s job market. Common roles include Financial Analysts, Account Managers, and positions in banking that all leverage core finance competencies, underscoring that job relevance to their degrees is largely based on the specific responsibilities and industries they enter.

However, it’s also evident that not all positions held by finance graduates relate closely to their studies. Some individuals have taken on roles in customer service, sales, and operations, where finance knowledge is less central. For example, positions such as Sales Associates, Operations Managers, and Customer Service Representatives may utilize financial principles occasionally but do not emphasize them as core qualifications. These findings illustrate that while finance graduates often seek and secure positions that reflect their academic training, there remains a significant number who navigate into roles that rely more on interpersonal skills or operational expertise rather than the strict application of financial theories.

Overall, finance graduates display an impressive versatility in their job titles, with a significant majority of them entering fields that align with their educational backgrounds. As the job market evolves, this adaptability is crucial for graduates, providing them with multiple pathways to apply their skills, whether in traditional finance roles or broader business contexts. While some roles may not fully utilize their finance expertise, the foundational knowledge gained from their degrees remains instrumental in fostering a career that often merges analytical skills with practical applications in various sectors.

Here is a visual representation of the most common words in job titles for Finance graduates:

Graduates with a degree in Finance tend to have a mixed bag of career trajectories in relation to the finance industry. When examining the profiles of individuals who have graduated from various universities, we can deduce some prevailing trends regarding their career paths shortly after graduation and five to ten years later.

For many recent graduates, their first job reflects a combination of entry-level positions that are somewhat related to finance and roles that are seemingly outside the field. For instance, a significant number started as analysts, associates, or interns at various financial institutions, like JPMorgan, Goldman Sachs, and other investment firms. Others, however, took on roles such as customer service representatives or office clerks which, while providing some relevant experience, do not seem to align directly with a finance-focused career. It suggests that while there are opportunities available for new finance graduates, not everyone is stepping directly into finance-focused positions. Some might experience difficulty in securing roles that capitalize on their degree right away, leading to broader career experiences.

As we look five to ten years later, the picture begins to clarify. A notable portion of the graduates who landed in finance-related roles initially have steadily climbed the ranks into senior analyst, vice president, and managerial positions. For example, many who began as financial analysts or assistants are now managing or directing teams at significant companies. Conversely, a portion of graduates seems to drift away from finance, moving into unrelated fields or slowly transitioning from lower-tier roles in finance to more stable, yet still lower-paying, positions outside the industry. There’s also a group that has ventured into entrepreneurial or self-employed paths, indicating a diversification in career trajectories among finance graduates. Overall, while there are many successful journeys that remain within the finance discipline, quite a few graduates seem to have found their niche in various fields, showcasing adaptability in their careers.

In summary, while many finance graduates embark on fruitful careers in finance-related roles quickly after graduation, there's also a notable number who find themselves in peripheral positions. As their careers progress, a clear divergence appears, with many solidifying their careers in finance or transitioning to other sectors entirely. The landscape suggests that a finance degree opens doors, but the path an individual takes can vary greatly based on circumstances, opportunities, and personal decisions along the way.

A Bachelor’s degree in Finance can be a bit of a mixed bag when it comes to difficulty. On one hand, if you're good with numbers and have a knack for analytical thinking, you might find a lot of the coursework pretty manageable. Topics like financial analysis, investment principles, and accounting can be a breeze if you stay on top of your studies. But on the flip side, some students find the heavier quantitative courses and complex concepts like derivative markets and risk management to be quite challenging. Overall, it’s probably around average in terms of difficulty compared to other degrees, but it really depends on your strengths and interests. Just be ready to put in the work and study hard, especially during exam season!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

When looking at the job histories of these finance graduates, a mixed picture emerges regarding their financial success. Many of those who graduated a while ago and have progressed to higher roles, such as managers or directors, clearly seem to be making substantial incomes. For example, graduates like those from prestigious institutions who have become Vice Presidents or hold senior analyst roles at well-known companies like Goldman Sachs or JPMorgan are likely pulling in six-figure salaries. However, some recent graduates, particularly those in entry-level positions or internships, might be earning less impressive salaries, starting closer to the lower end of the pay scale, especially if they work in roles like sales or customer service.

Overall, while there are likely varying levels of success among these individuals, those who have successfully climbed the corporate ladder in finance can be assumed to be doing quite well financially. In contrast, those in more junior or unstable job positions might be starting out with lower earnings, reflecting the typical career path in this field, where advancement can significantly impact income. Networking, experience, and strategic job choices seem key factors in determining one’s financial success in this profession.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance. This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: