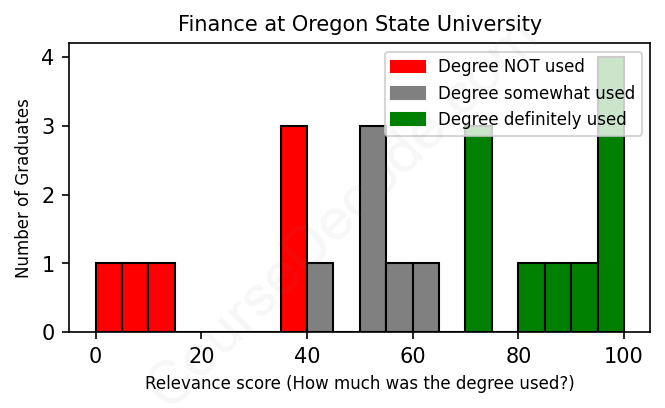

First, some facts. Of the Finance graduates from Oregon State University we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 22 LinkedIn profiles (see below).

The verdict? Below average. Overall, with an average relevance score of 59%, Finance graduates from Oregon State University have a lower likelihood (-8%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 18% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 59% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2010 from Oregon State University with a Bachelor's degree in Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONGeneral Manager Wongs Chinese Restaurant Jul 2011 - Jan 2018 Night Auditor  InterContinental Hotels Group (IHG) Apr 2018 - Sep 2019 Export Specialist  Allports Forwarding Inc. and Allports Inc. Feb 2021 - Present ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

Here is a visual representation of the most common words in job titles for Finance graduates (this is across all Finance graduates we've analyzed, not just those who went to Oregon State University):

The career trajectories of finance graduates from Oregon State University showcase a mix of paths, with some aligning closely with finance roles while others veer into different sectors. Many graduates seem to start their careers in positions that may not directly relate to finance, like restaurant management, customer service, or sales roles. For example, the 2010 grad had a stint as a General Manager for a restaurant before moving into an audit role at a hotel. Similarly, a 2014 graduate worked as a Member Service Representative at a credit union—still in the finance sector, but not a traditional finance role. Over time, as these graduates gain more experience, we do see a gradual shift towards more finance-related roles, such as financial analysts, budget technicians, and even consultants in various capacities.

By the five- to ten-year mark post-graduation, many of these alumni exhibit significant career growth within more relevant fields. For instance, the 2019 graduate who started as an accounts payable specialist eventually transitioned to a role as an underwriting analyst, demonstrating clear career advancement in finance. Others, like a 2018 graduate, moved through various operational roles at Target before ascending to managerial positions. Overall, while there is some initial divergence in career paths, it seems that many Oregon State finance graduates eventually find their way into finance roles or related fields as they progress in their careers. So, while the starting jobs may not all scream “finance,” many of these graduates eventually carve out solid careers that align more closely with their degree.

Getting a Bachelor’s degree in Finance at Oregon State University is pretty on par with what you'd find at most schools. While it’s not a walk in the park, it’s definitely manageable if you’re willing to put in the effort. Expect to dive into some challenging coursework like financial modeling, investment analysis, and economics, but if you have a decent grasp of math and enjoy problem-solving, you should do fine. The workload can ramp up, especially during midterms and finals, but with good time management and study habits, it’s definitely achievable. So, while it has its tough moments, it’s not the hardest degree out there—you just need to be ready to roll up your sleeves and get to work!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

So, looking at these finance grads from Oregon State University, it seems like they’ve landed a mix of jobs that probably pay okay, but nothing too flashy. You've got some going from restaurant management and night auditing to roles like budget analysts and sales reps, which can be decent but often aren't super high-paying, especially at the start of their careers. A few have moved into higher-tier roles, like the Coronary Senior Clinical Specialist and some at places like Target in operations management, which likely gives them a better paycheck. But overall, it feels like they’re in that typical grind of starting out in a range of positions—getting solid experience but not hitting big numbers immediately. So, in a nutshell, they’re probably making a decent living, but they might not be rolling in it just yet!

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance (this is across all Finance graduates we've analyzed, not just those who went to Oregon State University). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: