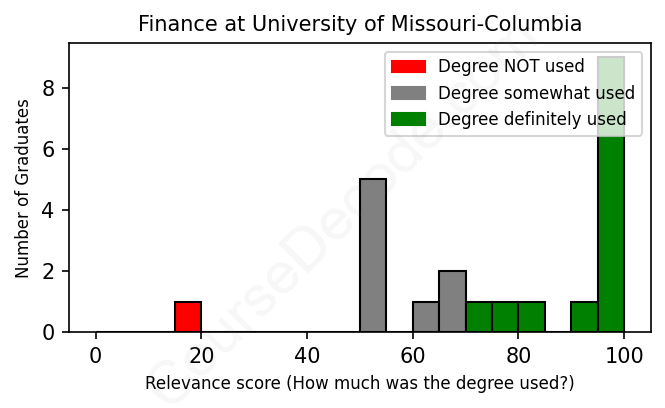

First, some facts. Of the Finance graduates from University of Missouri-Columbia we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 22 LinkedIn profiles (see below).

The verdict? Above average. Overall, with an average relevance score of 76%, Finance graduates from University of Missouri-Columbia have a higher likelihood (+9%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 4% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 100% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2019 from University of Missouri-Columbia with a Bachelor Science of Business Administration - BBA in Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONFinancial Account Representative RTS Financial Jun 2019 - Mar 2021 Team Coordinator  RTS Financial Mar 2021 - Jul 2021 Operations Supervisor  RTS Financial Jul 2021 - Present ABOUTI graduated from the University of Missouri, where I studied business administration with an emphasis in both finance and real estate. I currently work at RTS Financial as an Operations Supervisor where I get to lead a team of Account Representatives to help our carrier clients with their funding needs and partner with them to inspire growth. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

Looking through the job profiles of University of Missouri-Columbia Finance graduates, it's pretty clear that many of them kick-start their careers in positions that are closely tied to finance. A good chunk of them have taken roles like Loan Officers, Commercial Bank Officers, Investment Analysts, and Financial Advisors. These jobs not only require a solid understanding of financial principles but are also a direct application of what they learned during their degree. For instance, working as a Loan Officer or Commercial Bank Officer entails assessing financial situations and evaluating loans, which is right up the finance alley! Even roles like Real Estate Analyst and Wealth Advisor show clear relevance to their finance backgrounds.

However, not every job seems to relate directly back to their finance studies. Some graduates have found themselves in roles like MWD Field Operator or Job Coach, which focus more on technical skills or career development rather than finance itself. Similarly, some positions in accounting or operational support may not make the most of their finance education, even if they involve some financial elements. Overall, while many jobs align nicely with a finance degree, others drift away from the central finance concepts, showing that the degree can lead down various paths—even ones that don’t directly capitalize on the extensive finance knowledge gained in college.

Here is a visual representation of the most common words in job titles for Finance graduates (this is across all Finance graduates we've analyzed, not just those who went to University of Missouri-Columbia):

When you look at the career paths of graduates from the Finance program at the University of Missouri-Columbia, you can definitely see a strong trend toward various roles that are closely linked to finance, banking, and investment. For many graduates, their first jobs right after graduation often fall into entry-level positions like loan officers, financial advisors, or accounting roles, which is pretty typical for someone starting in the finance field. It appears they use these initial positions as stepping stones to more advanced roles over the next five or ten years.

If you check out their trajectories, most of them seem to have progressed into mid-level and senior roles. Many who started as loan officers or in entry-level finance roles have moved up to positions like commercial bank officer, community bank manager, and even financial planning directors. A few have even ventured into niche areas like real estate analysis or fixed income trading. While a handful of graduates have found their way into sectors that aren’t strictly finance-related, the majority show a clear path in the finance realm, indicating that a degree from this university can lead to solid career opportunities in the field. Overall, it looks like these graduates are making the most of their degrees, carving out successful careers with relevant experiences along the way!

Getting a Bachelor’s degree in Finance at the University of Missouri-Columbia is generally considered to be on the moderately challenging side, much like finance programs at many other universities. You’ll dive into topics like financial analysis, investment strategies, and economic theory, which can all be pretty heavy on math and critical thinking. So, if you’re not a numbers person, it might feel a bit tough. On the flip side, if you enjoy problem-solving and working with data, you might find the material interesting and manageable. Overall, it's not a walk in the park, but with dedication and good study habits, many students find they can navigate through it. Just be prepared to put in some effort, especially if you want to keep your grades up!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

Looking at these finance graduates from the University of Missouri-Columbia, it seems like a mixed bag in terms of making good money. The earlier graduates, especially those who climbed the ladders in banking and financial services, like the Loan Officer who has been at Veterans United since 2011 and the VP at Citizens Bank & Trust, likely pull down decent salaries, often augmented with bonuses. Others, particularly from the more recent classes (2020-2023), are still starting off in entry-level roles, which typically don’t pay as well initially, but they’re in fields with good growth potential. So, while some folks are definitely banking nice salaries, others are still getting their foot in the door, and it might take them a little while to hit those higher income levels. Overall, it seems like there’s good earning potential, but it varies based on experience and specific career paths.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance (this is across all Finance graduates we've analyzed, not just those who went to University of Missouri-Columbia). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: