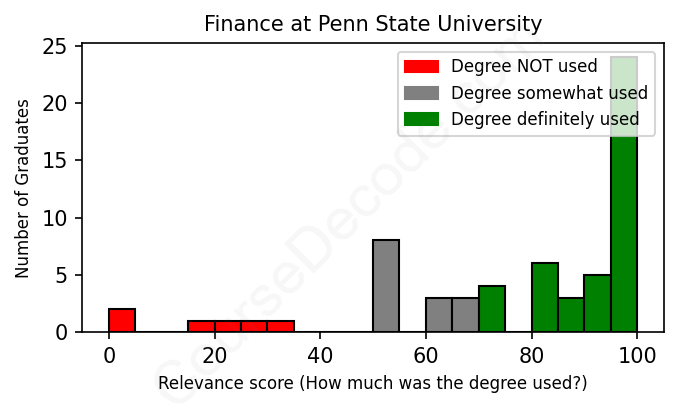

First, some facts. Of the Finance graduates from Penn State University we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 62 LinkedIn profiles (see below).

The verdict? Above average. Overall, with an average relevance score of 76%, Finance graduates from Penn State University have a higher likelihood (+9%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 22% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 83% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2013 from Penn State University with a Bachelor of Science - BS in Finance. Also pursued further education since (see below). JOB HISTORY SINCE GRADUATIONResearch Assistant Roland Berger Jul 2013 - Nov 2013 Columbia Tech Team  The Opportunity Project with U.S. Census Bureau and U.S. Environmental Protection Agency Sep 2020 - Dec 2020 Co-Founder  R Story Dec 2020 - May 2021 Research Assistant  Columbia Business School Dec 2019 - Jun 2021 FURTHER DEGREES DONE SINCE GRADUATINGMaster of Science - MSThe Graduate School of Business Seoul National University 2014 - 2018 Master of Arts - MA Columbia University in the City of New York 2019 - 2021 ABOUTI am the co-founder of R Story. I participated in a Open Innovation Lab's Opportunity Project university sprint administered by U.S. Census Bureau and U.S. Environmental Protection Agency. To know more about R Story you are more than welcome to visit the below links:The Opportunity Project Website: https://opportunity.census.gov/showcase/Orange Sparkle Ball Blog: https://www.orangesparkleball.com/0_blog/2020/12/23/rural-economic-development-rstory-tool-for-economic-developersInstagram: https://www.instagram.com/rstorytool/ |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When we look at the career paths of Finance graduates from Penn State University, we see a pretty wide array of jobs, each with varying levels of relevance to their degree. Some alumni have landed positions that clearly connect to their finance education, like Financial Analysts and Finance Managers. However, there is also a significant number who have ventured into roles that don't utilize their finance background to its fullest potential. Instead, they find themselves doing things like technical support, customer service, and project management, which might benefit from some financial knowledge, but don’t strictly require it.

Among the most common job titles, we see positions like Financial Analyst, Financial Consultant, and different managerial roles in finance-related sectors. These positions are highly relevant as they require strong financial acumen and daily use of concepts learned during their studies. On the flip side, roles such as Customer Care Representatives, Operations Specialists, and various technical positions (like Associate Technicians or Engineers) seem pretty disconnected from the rigorous financial training that these graduates received. For example, working as a Technician at Verizon might involve problem-solving skills, but it lacks the core finance focus expected from someone with a Finance degree.

Overall, it seems like many of these graduates have indeed found paths that resonate with the skills acquired through their education, while others have drifted into roles that, while potentially rewarding and beneficial, don't leverage their finance knowledge as much as one would hope. It suggests a mixed bag where networking, personal interests, and market conditions may have influenced their career trajectories just as much as their educational background.

Here is a visual representation of the most common words in job titles for Finance graduates (this is across all Finance graduates we've analyzed, not just those who went to Penn State University):

Analyzing the career trajectories of graduates from Penn State University's finance program reveals some interesting patterns. Most graduates start their careers in roles deeply connected to finance, such as financial analysts, accounting positions, and roles in banking or insurance. In their first jobs, many seem to land positions with reputable companies like J.P. Morgan, Bank of America, and EY, which suggests that they are stepping into the workforce with a strong foundation and network. For example, a number of graduates became financial analysts soon after graduating, which aligns perfectly with their finance education.

Fast forward 5 to 10 years, and the picture becomes even more notable. A significant portion of these graduates has moved up the ranks, transitioning into higher management roles such as finance managers, senior analysts, and even directors. For instance, those who started as financial analysts often found their way to senior roles at their initial companies or took positions with other major firms, indicating a healthy pipeline of career advancement in finance. There are also a few graduates who ventured into entrepreneurship or founded their own companies, showcasing the versatility of their finance education.

However, not every path taken by these graduates leads them directly into finance. Some landed in roles that seem slightly off the beaten path—like in tech or education—suggesting that while they may have started their careers in finance, they later switched industries. Despite this, it appears that many still utilize their finance backgrounds in roles like data analysis or project management. Overall, it can be observed that Penn State finance graduates tend to have solid career trajectories, with a fair share successfully carving out good careers within finance or fields closely aligned with their skills. While a few may have ended up in unrelated jobs, the majority seem to thrive and build meaningful careers in finance-related roles.

Getting a Bachelor’s degree in Finance at Penn State isn’t a walk in the park, but it’s also not the hardest thing in the world. Like most finance programs, it’s got its share of challenging courses—think lots of math, economics, and analytical thinking—but if you're good with numbers and have a genuine interest in how money works, you might find it pretty manageable. Some students say the workload can be intense at times, especially around finals or project deadlines, but with solid time management and a bit of effort, it’s definitely doable. Overall, it’s fairly typical in difficulty compared to other finance programs, so if you’re up for the challenge, you can totally handle it!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

Looking at this list of recent Penn State Finance grads and their job paths, it seems like they’re in pretty decent financial shape overall. Graduates from earlier years, particularly those who started their careers around 2010, show a solid trajectory, often moving from entry-level positions to roles like Senior Financial Analyst and Manager, which usually come with higher salaries. For example, one grad who worked at Verizon reached the role of Principal Engineer, which suggests a significant boost in earnings over time. Similarly, another graduate went from Analyst to Finance Manager at major companies like Johnson & Johnson. These are clear indicators of career growth and higher compensation coming with experience.

However, not all paths seem equally lucrative. Some graduates, like the Insurance Adjuster, may be earning less compared to their peers in more analytical or managerial roles. There’s also a mix of people still hunting for their niche or just starting, especially those who graduated more recently, like in 2022 and 2023, who often start off in internships or entry-level jobs that can be lower paying. Still, most of the roles listed here align with the expectations of the finance field, where upward mobility and salary growth are pretty common as experience builds. Overall, it seems like a lot of these grads are on the right track towards making decent money in their careers!

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance (this is across all Finance graduates we've analyzed, not just those who went to Penn State University). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: