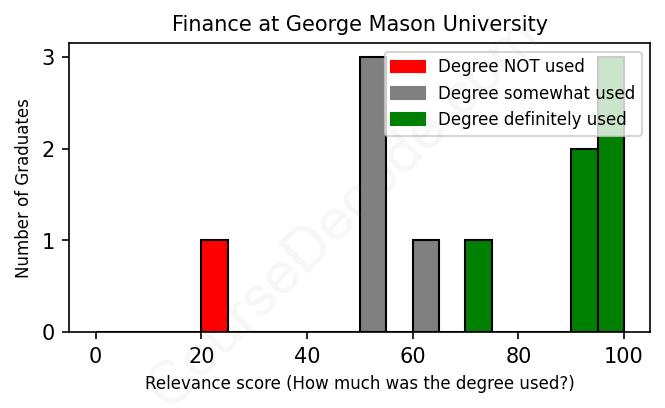

First, some facts. Of the Finance graduates from George Mason University we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 11 LinkedIn profiles (see below).

The verdict? Slightly above average. Overall, with an average relevance score of 72%, Finance graduates from George Mason University have a slightly higher likelihood (+5%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 18% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 100% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2022 from George Mason University with a Bachelor of Science - BS in Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONFinancial Analyst Northrop Grumman Aug 2022 - Present ABOUTPrepare, analyze, and present monthly, quarterly, and yearly balance sheet reports to division, sector, and corporate senior leadership.Deliverables include complete balance sheet analysis; unbilled, billed, and aged accounts receivables; reserves; contracts in process; advances on contracts; intercompany cash; capital expenditures; journal entries; forward losses; risk work authorizations; treasury; contract liability revenue disclosures; and international capital reports.Prepare monthly balance sheet rolling forecasts and yearly AOP forecasts.Prepare and present quarterly SOX controls to Deloitte.2024 Digital transformation SME training lead for COGNOS and S4 HANA.Balance sheet trainer for business units, operating units, and major programs.Received the 2023 Bravo to our Stars monetary award for showing exceptional leadership and going above and beyond my scope of work. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

Looking at the jobs held by graduates of George Mason University's Finance program, it’s clear that many of them have found positions that directly tie back to their education. The most common roles include Financial Analyst, Finance Manager, and various senior finance positions within organizations, especially in firms like General Dynamics Information Technology and NASTAD. These roles, such as Senior Financial Analyst or Finance Director, typically involve critical tasks like budgeting, forecasting, and high-level strategic planning, making them highly relevant to the knowledge they gained during their studies. It’s evident that those who pursued finance-related positions have been able to effectively apply their education in practical, meaningful ways.

However, there are also several examples of graduates who have taken on roles that aren't as closely aligned with their Finance degree. Jobs like Travel Agent or even positions in customer service, such as Client Service Representative, don’t require in-depth financial knowledge and highlight a more indirect application of a finance degree. While some may utilize basic financial concepts, the connection to core finance functions is quite limited. Overall, it seems that while many graduates are working in highly relevant finance-related jobs, others have ventured into positions where their finance background is not fully leveraged, demonstrating the versatility of a Finance degree in the job market.

Here is a visual representation of the most common words in job titles for Finance graduates (this is across all Finance graduates we've analyzed, not just those who went to George Mason University):

Looking at the career trajectories of graduates from George Mason University with a Finance degree, you can really see some interesting patterns! For many of these individuals, their first jobs right out of college often involve roles such as finance analysts, client service representatives, or even positions that seem a bit more niche, like travel agents. For example, a lot of graduates from around 2010 started in analyst roles and then climbed up the corporate ladder in companies like General Dynamics and Barnum Financial Group. It seems like those who got their careers rolling in finance have generally maintained a pretty linear career path, advancing into managerial and director-level positions within a decade. Many of them appear to be sticking within the finance sector, which is a solid sign that their education paid off and led to meaningful, relevant careers.

However, not everyone went straight into finance-related jobs; some graduates found themselves in more unexpected roles, like transportation CEOs or as freelancers in photography, showcasing that the path isn't always traditional. A few people shifted entirely away from finance and into fields that might not seem directly related but still utilize their skills in management and analysis. In recent years, graduates from 2020 and 2022 are starting to step into roles that resonate with finance, like associate positions in finance and accounting, which is promising for the younger crowd. Overall, while there is a mix of outcomes, it generally looks like many graduates are managing to carve out good careers in finance-related positions, especially as time goes by.

Getting a Bachelor’s degree in Finance at George Mason University, or really any university, can be a mixed bag. It’s definitely not a walk in the park, but it’s not impossible either. You’ll dive into subjects like financial analysis, accounting, and economics, which can get pretty intense, especially if math isn’t your jam. The workload can be heavy at times, with projects and exams that require some serious dedication. Ultimately, if you’re passionate about the subject and stay organized, it’s totally manageable. Just be ready to put in some effort, and it should be a rewarding experience!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

Looking at the career paths of these George Mason University finance grads, it seems like some are doing pretty well, especially those who climbed the ranks in stable companies like General Dynamics—going from a cost analyst to a finance director shows a solid upward trajectory that usually comes with decent pay. On the flip side, others are still in more entry-level or mix-and-match roles, like travel agents or assistants, which might not be as lucrative. The alumni from 2011 and 2012 also showed some promising job titles, indicating they likely make a good salary now. Overall, it looks like while some are definitely raking in the dough, others might still be hustling to reach that sweet spot.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance (this is across all Finance graduates we've analyzed, not just those who went to George Mason University). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: