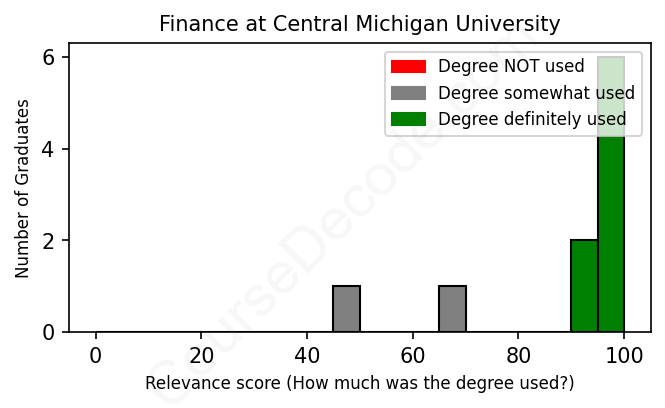

First, some facts. Of the Finance graduates from Central Michigan University we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 10 LinkedIn profiles (see below).

The verdict? Great! Overall, with an average relevance score of 90%, Finance graduates from Central Michigan University have a substantially higher likelihood (+23%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 10% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 100% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2013 from Central Michigan University with a Bachelor of Science in Business Administration (BSBA) in Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONFinancial Analyst Bridgewater Interiors, LLC Jul 2013 - Jul 2014 ABOUTI graduated from Central Michigan University in May 2013. There, I majored in Finance, with a Bachelor of Science in Business Administration degree. I work for an Automotive Interior Systems Manufacturer. I am pursing a career in corporate finance. It's my belief that my zealous nature and willingness to learn make me well-positioned to succeed in this endeavor. Moreover, I'm a driven, forward-thinking individual and excited for opportunities for personal and professional growth. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

Looking at the LinkedIn profiles of graduates from Central Michigan University with a degree in Finance, it seems like a lot of them have landed jobs in various roles related to financial analysis, credit evaluation, and banking. Positions like Financial Analyst, Credit Analyst, and Engagement Financial Advisor are pretty common and directly use the knowledge and skills learned during their finance studies. These roles usually involve analyzing financial data, forecasting budgets, and advising on financial decisions, which are all key components of a finance degree. So, for those looking to see the connection, many of the jobs are pretty relevant to the field of finance.

However, not all jobs held by these graduates seem to tap into their finance expertise as much. Some of them have taken roles that focus more on customer service, operations, or administrative tasks, like tellers or office managers at non-financial companies. While some aspects of their education may still come into play, jobs like those don't fully utilize their finance-specific training. Overall, it's a mixed bag—many graduates are in strong finance roles, but there are also several who have veered off into positions that don't apply their degree as much.

Here is a visual representation of the most common words in job titles for Finance graduates (this is across all Finance graduates we've analyzed, not just those who went to Central Michigan University):

The career trajectories of Central Michigan University Finance graduates show that many find their footing in finance-related jobs relatively quickly after graduation. For instance, recent graduates have taken on roles such as Financial Analysts, Credit Analysts, and even positions in banks, all of which directly align with the field of finance. This suggests a solid entry into the industry, as they seem to be leveraging their degrees well. However, it's also clear that some graduates have had varied paths; for example, one graduate who started as a Teller moved through several unrelated roles before landing an Executive Administrative Assistant position. This indicates that while some graduates are finding relevant roles right away, others might be taking a bit longer to break fully into the finance sector.

When looking longitudinally, say five or ten years down the line, it appears many graduates have escalated to more senior positions, often within financial institutions or consulting firms like Deloitte. Roles like Senior Engagement Financial Advisor and Lead Systems Optimization Analyst point to a trend where these individuals have built substantial careers in finance, often maintaining relevance in their field. That said, there's a noticeable mix of paths taken; some individuals have diverted into roles not directly tied to finance, such as office management or maintenance. Overall, while a good number of CMU Finance grads seem to be finding success and advancing in finance-related careers, there’s also a portion that has explored other avenues, which could either reflect personal choices or challenges in the job market. It's a mixed bag, but definitely, there’s potential for growth in finance for many of these graduates!

Getting a Bachelor’s degree in Finance at Central Michigan University is pretty much on par with what you’d expect for a finance degree anywhere else. It can be challenging, especially with all the math and analytical stuff you’ll be dealing with, like financial modeling and statistics. Some classes may feel tough, particularly if you’re not super into numbers or economics. But if you stay organized, manage your time well, and are willing to put in the effort, you should be just fine. There’s a solid support system in place, so it’s definitely doable—you just have to be ready to hit the books and engage with the material!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

Looking at these Finance graduates from Central Michigan University, it seems like they're generally on a decent track when it comes to making money, especially once they start to settle into their careers. For example, those who graduated a bit earlier, like in 2011 and 2013, have moved through a few roles that likely pay better over time, especially those ending up in higher positions at places like Deloitte and Flagstar Bank. The more recent grads, like the 2023 ones, are starting off as financial analysts, which can be a solid entry position in the finance world. Overall, while they may have started with some lower-paying roles (like the teller and clerk jobs), it looks like they’ve worked their way up to better salaries, so it’s safe to say they’re making decent money now and have good potential for future earnings!

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance (this is across all Finance graduates we've analyzed, not just those who went to Central Michigan University). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: