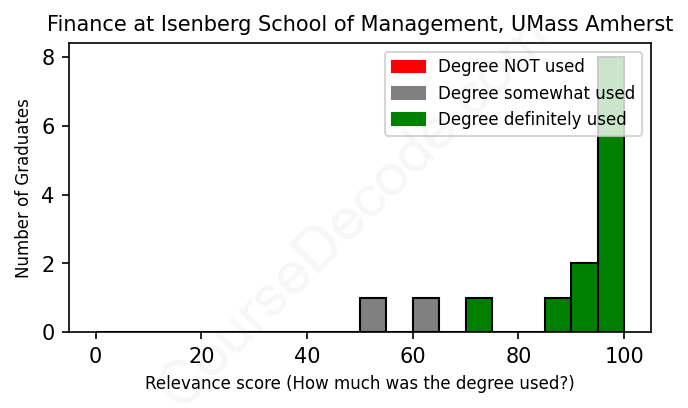

First, some facts. Of the Finance graduates from Isenberg School of Management, UMass Amherst we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 14 LinkedIn profiles (see below).

The verdict? Great! Overall, with an average relevance score of 90%, Finance graduates from Isenberg School of Management, UMass Amherst have a substantially higher likelihood (+23%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 0% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 89% We think this person has gone into a career highly relevant to their degree. We think this person has gone into a career highly relevant to their degree.

DEGREE INFOGraduated in 2022 from Isenberg School of Management, UMass Amherst with a Bachelor of Business Administration - BBA in Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONWorkplace Planning Associate Fidelity Investments Jun 2022 - Nov 2022 Credit Analyst  Bauer Hockey Feb 2023 - Present ABOUTSince I was a little kid, I was always told to save my money to plan for the future. I made sure to keep those lessons in mind when saving parts of my paychecks from High School jobs. This saving and planning eventually led me to be interested in the Financial Analysis field. I am skilled in Self-management, Public Speaking, Organization Skills, Time Management, and Strategic Planning. I am a Driven student working towards a Bachelor of Business Administration - focused in Corporate Finance, from Isenberg School of Management, UMass Amherst. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When looking at all these alumni from the Isenberg School of Management at UMass Amherst, it’s pretty clear that many of them are in roles that really connect with their Finance degree. A lot of them have ended up working in financial services, investment analysis, and related fields like private equity and portfolio management. For instance, positions like Private Equity Officer, Portfolio Manager, and Analyst roles at major firms like JPMorgan Chase & Co. and Goldman Sachs show that their education has guided them into jobs where they are required to use advanced financial skills and knowledge daily, making these roles highly relevant to their studies.

However, there are definitely some jobs that don’t quite fit the finance mold. You’ve got people working as Operations Specialists or Client Services Analysts who aren't really diving into core finance concepts on a regular basis. It's a mixed bag overall; while many alumni are in roles that are spot-on relevant, some have ventured into positions that don't utilize their finance backgrounds as much. So, if you're considering a finance degree, know that it can lead you to exciting finance-centric careers, but there are also paths that might stray away from the thick of finance depending on personal interests and career choices!

Here is a visual representation of the most common words in job titles for Finance graduates (this is across all Finance graduates we've analyzed, not just those who went to Isenberg School of Management, UMass Amherst):

Graduates from the Isenberg School of Management at UMass Amherst generally have solid career trajectories after completing their degrees in Finance. For many of these individuals, the first job out of college tends to be in analytical or entry-level roles that are directly tied to financial services, accounting, or investment management. Positions like Accounting Pricing Specialist and Client Services Analyst seem to be quite common for recent grads. Over the next five to ten years, many of these professionals progress into more specialized or senior positions, often within the same company or industry, as seen with those climbing the ranks at firms like State Street, JPMorgan Chase, and KPMG.

By the time they reach the five to ten-year mark, many graduates are not just sticking to entry-level tasks; they are taking on significant responsibilities and management roles such as Private Equity Officer, Senior Associate, or even Assistant Vice President. It's also interesting to note that some individuals do shift industries or roles, moving into areas like data management or credit analysis, which still leverage their finance backgrounds. Overall, it looks like these grads have developed strong, relevant careers in finance, with many finding themselves in good roles that align with their educational backgrounds. They seem to benefit from a solid education and networking opportunities through their university, setting them up for success in the finance field.

Getting a Bachelor’s degree in Finance at the Isenberg School of Management, UMass Amherst, can be a bit of a mixed bag, to be honest. It’s not the easiest degree out there, but it’s also not the most brutal. You’ll have to dive into some tough subjects like financial management, investments, and accounting, and there will be a good amount of math involved, especially if you’re not super comfortable with numbers. Some students find the group projects and case studies really engaging, while others think they can be a drag. Overall, if you stay on top of your studies and don’t mind putting in the effort, it’s totally manageable, but be prepared to put in some work!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

Looking at the career paths of these finance grads from UMass Amherst, it seems like many of them are doing pretty well financially, especially those who graduated earlier. The grads from 2012 and 2014 are climbing the corporate ladder at places like State Street and Brookline Bank, moving into roles like Assistant Vice President and Portfolio Manager, which usually mean good paychecks. Those who graduated more recently, like in 2023, are still in the early stages of their careers, so they might not be raking in the big bucks just yet. But overall, it looks like if they keep progressing in their respective fields, they'll likely be earning decent salaries not too far down the line.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance (this is across all Finance graduates we've analyzed, not just those who went to Isenberg School of Management, UMass Amherst). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: