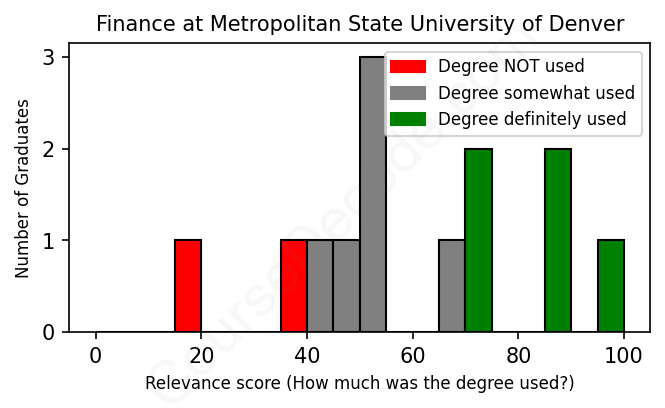

First, some facts. Of the Finance graduates from Metropolitan State University of Denver we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 13 LinkedIn profiles (see below).

The verdict? Below average. Overall, with an average relevance score of 60%, Finance graduates from Metropolitan State University of Denver have a lower likelihood (-7%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 15% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 65% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2020 from Metropolitan State University of Denver with a Bachelor's degree in Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONCredit Analyst HTLF Nov 2020 - Jan 2022 Property & Casualty Portfolio Underwriter  Zurich North America Jan 2022 - Present ABOUTNo information provided. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

Here is a visual representation of the most common words in job titles for Finance graduates (this is across all Finance graduates we've analyzed, not just those who went to Metropolitan State University of Denver):

The career trajectories for graduates from Metropolitan State University of Denver who studied Finance show a mix of success and varied paths. For many, the first jobs right after graduation tend to be somewhat related to finance, such as roles as credit analysts, production accountants, or financial service representatives. For example, graduates who completed their studies in the early 2010s have moved into positions that allow them to build on their initial roles; many have progressed to higher positions in finance and operations, showing a steady growth in their careers relevant to their degree. The common thread seems to be that they often start in analytical or administrative roles but transition into more specialized finance positions as they gain experience.

However, there are also instances where graduates have drifted away from traditional finance paths over time. Some have taken on roles that, while important, may not be directly aligned with finance, like project management or operations manager positions in retail. For those graduating more recently, there are instances of working in entirely different fields initially, such as delivery driving or warehouse roles, which suggests that the job market can be competitive or that some graduates may not have secured finance-centric positions immediately after school. Overall, while many have found their way into meaningful finance-related careers over the years, there’s a notable diversity in the career paths taken, indicating that not everyone ends up in their degree field immediately after graduation—or even years down the line.

Honestly, a Bachelor’s degree in Finance can be a bit of a mixed bag, and it really depends on your personal strengths and interests. At Metropolitan State University of Denver, you might find that the coursework is pretty manageable if you have a knack for numbers and enjoy analyzing data. It’s definitely more challenging than some other liberal arts degrees, but it's not the hardest out there either. You’ll dive into topics like investment, financial theory, and corporate finance, which can be interesting if you like practical applications. Just be prepared for some math and analytical work, but if you stay on top of your studies and engage with the material, you should be able to navigate through it without too much stress!

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

Looking at these finance grads from Metropolitan State University of Denver, it seems like a mixed bag in terms of money-making potential. Some have climbed the ladder pretty impressively, like the one who's now a Senior Director of Operations & Transitions at Sage Hospitality Group, which usually pays well. Others, especially those in more entry-level roles or in industries like retail or food service, might not be raking in the big bucks just yet. For those who landed solid positions early on, like project managers and finance directors, it looks like they’re well on their way to decent salaries, especially since many of them are still working up in reputable firms. But for recent grads still in internships or entry-level jobs, it's likely they haven't hit those high earnings yet. Overall, some are doing great and are set for good financial futures, while others are just starting out and have some catching up to do.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance (this is across all Finance graduates we've analyzed, not just those who went to Metropolitan State University of Denver). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: