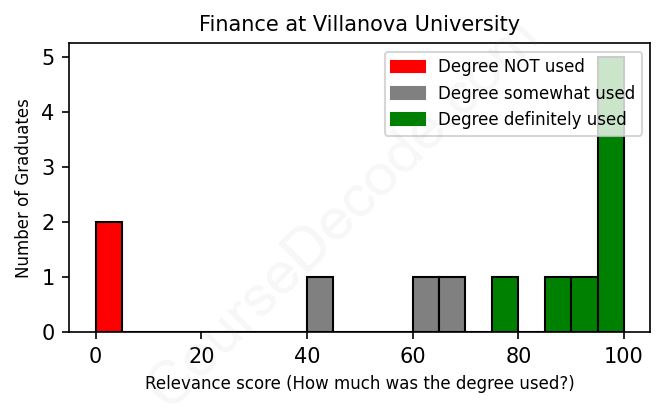

First, some facts. Of the Finance graduates from Villanova University we've analyzed , here's how many have used (or NOT used) their degree in their career:

These are estimates based on AI analysis of 13 LinkedIn profiles (see below).

The verdict? Slightly above average. Overall, with an average relevance score of 71%, Finance graduates from Villanova University have a slightly higher likelihood (+4%) of finding work in this field compared to the average graduate across all fields:

And for comparison, here's the chart for all profiles we've looked at across all degrees.

Also, after graduating, only 23% of these graduates have pursued further education other than another Bachelor's degree (such as a Masters degree or other), compared to the average across all profiles of 35%. This suggests a Bachelors degree is enough for most Finance graduates, and it's normal to look for work straight after graduation.

See the details:

|

Relevance score: 43% We think this person has gone into a career only somewhat relevant to their degree. We think this person has gone into a career only somewhat relevant to their degree.

DEGREE INFOGraduated in 2013 from Villanova University with a Bachelor of Arts - BA in Finance. No other secondary education since. JOB HISTORY SINCE GRADUATIONClinical Specialist - Northeast Region Stereotaxis 2014 - 2015 Senior Clinical Specialist - Northeast Region  Stereotaxis 2015 - 2017 Territory Manager - Northeast Region  Stereotaxis 2017 - 2019 Area Business Manager/Field Sales Trainer - Northeast Region  Stereotaxis 2019 - 2022 Regional Business Director  Volta Medical Nov 2022 - Present ABOUTI am a clinical technologies sales leader who has played a pivotal role in growing a high-stakes territory and charting overall operations for a global company. My metrics show that I know well the rhythms of the New York City healthcare system and the nuances of strategic account execution in a highly technical space. My background includes specialized training and deep perspective around Cardiac Electrophysiology, which means I have worked in tandem with highly trained cardiac specialists and clinical directors, balancing my knowledge with theirs in charting a course for technology adoption and sustainment. I move toward challenges and strong personalities with energy and optimism, always backed by knowledge. Highly technical change takes trust. I have built a strong network and become the partner of choice for many specialists. I take that same communication strength and authenticity to training internally as well. From compensation planning to service contracts to the magnetic system that helps hearts beat regularly, my ability to fully absorb and deftly deploy details has been key to my success. |

The top 10 most common jobs done by the graduates we've analyzed (ranked most common to least) are:

When looking at the job history of Villanova University Finance graduates, it seems there are a few standout roles that these individuals commonly pursue. A large number of them have found their way into positions like Credit Risk Managers, Investment Analysts, and various roles in Investment Banking. These jobs are pretty solid examples of how finance graduates can apply their skills in real-world scenarios, demonstrating a clear link between their education and their careers. Overall, many of these positions are highly relevant to finance and directly utilize the analytical, quantitative, and strategic skills that were honed during their studies.

However, it's also interesting to note that not all positions are directly finance-related. Several graduates ended up in roles that, while they might use some financial knowledge occasionally, don't primarily focus on finance, like Customer Service Representatives or even positions in legal internships. This shows that while many graduates do land roles aligned with their degree, there’s still a significant portion who venture into other fields that might not make the best use of their finance education. So, while it's great to see a strong correlation between their degree and career, there's definitely a mix in how relevant those jobs truly are to their Finance background.

Here is a visual representation of the most common words in job titles for Finance graduates (this is across all Finance graduates we've analyzed, not just those who went to Villanova University):

It looks like graduates from Villanova University's Finance program have had a pretty solid start to their careers. Many of the people I've looked at often secure roles that are directly related to finance soon after graduating, such as analysts at major banks and investment firms. For example, graduates from 2012 and 2013 landed roles at big names like Goldman Sachs, BNY Mellon, and Goldman Sachs again, showcasing a clear trajectory into the heart of the finance world. It seems like the connections and skills gained during their studies set them up well for these competitive positions right out of college.

Fast forward five to ten years, and the trend continues with a good number of graduates moving up the ladder into senior roles. Positions evolve into managerial and director-level jobs at reputable firms, indicating a promising advance in their careers. For instance, some have transitioned from analyst roles to senior portfolio managers or even managing directors at top companies. Even those who started in more tangential roles, like finance analysts or business consultants, have managed to navigate their paths back into finance-centric careers. Overall, it seems that Villanova graduates are doing quite well within the finance industry, with many finding relevant jobs that lead to successful careers after just a few short years. So, if you're considering a degree in Finance at Villanova, it looks like it's a smart move!

Honestly, a Bachelor’s degree in Finance at Villanova can be pretty challenging, but it really depends on your strengths and interests. Finance is a mix of math, economics, and a bit of business strategy, so if you enjoy working with numbers and understanding how markets work, you might find it more manageable. Villanova has a solid reputation, so you can expect rigorous coursework and some tough professors, which can make it feel more demanding than other degrees. That said, if you put in the effort and stay organized, you can definitely handle it! Overall, it’s probably around the average level of difficulty, but just be prepared to study and keep up with assignments.

Most commonly, in the LinkedIn profiles we've looked at, it takes people 4 years to finish a Bachelor degree in Finance.

Looking at these Villanova graduates, it seems like many of them are doing pretty well financially, especially those who landed jobs at top firms like Goldman Sachs, JPMorgan, and UBS. Graduates from 2012 and 2014, for instance, have climbed the ladder fast with significant roles in major finance companies, which likely pays pretty well. Even those who started in internships or lower-level positions eventually moved up to much better-paying positions, like credit risk management or portfolio management, which is solid. Sure, some earlier careers took more traditional paths, like in consulting or finance analyst roles, but there’s potential for good earnings there too, especially since those roles often come with bonuses. Overall, it looks like these alumni are generally earning decent salaries that should have them set up nicely for the future.

Here is a visual representation of the most common words seen in the "about" section of LinkedIn profiles who have a Bachelor degree in Finance (this is across all Finance graduates we've analyzed, not just those who went to Villanova University). This may or may not be useful:

Here are all colleges offering a Bachelor degree in Finance (ordered by the average relevance score of their Finance graduates, best to worst) where we have analyzed at least 10 of their graduates: